Dropshipping Legal Compliance: Navigating Trademarks, Taxes, and Returns in 2025

Dropshipping is still allowed in 2025, but you must follow rules. Many online shops like this way of selling. In 2024, about 27% picked dropshipping. It helps you avoid keeping stock and grow quickly.

You pay for items only after customers order them, so you save cash and lower risk.

But you need to be careful about legal problems:

Tax errors

Data safety issues

Supplier deals that are not clear

Dropshipping Legal Compliance helps you trade safely and keep your shop strong.

Key Takeaways

Dropshipping is still allowed in 2025. You must follow the laws in every country you sell to.

Always sign up your dropshipping business. Keep good records to meet tax and legal rules.

Check trademarks and copyrights closely. This helps you avoid selling fake or unauthorised branded items.

Follow each platform’s dropshipping and intellectual property rules. This stops your account from being suspended or fined.

Learn and use sales tax, VAT, and income tax rules for every place you have customers.

Make clear return policies that match local laws. Tell your customers about them in simple words.

Keep customer data safe during returns. Follow privacy laws like GDPR to help customers trust you.

Keep learning about new legal changes. Run checks, train your team, and ask experts for help.

Dropshipping Legal Compliance

Legal Status 2025

You may ask if dropshipping is still allowed in 2025. The answer is yes. Dropshipping is a legal way to do business in the United States, United Kingdom, and European Union. You must follow online shop laws and special rules for each country. In the US, you need to register your business, pay taxes, and keep customers safe. The EU wants you to show who you are as a seller and tell buyers about delivery costs, especially for goods from other countries. The UK has similar rules for online shops and protecting buyers.

There are other rules to think about too. These include copyright, product safety, honest adverts, and keeping data safe. If you sell food, medicine, or alcohol, you will have extra checks. Some places have rules about stopping money crimes, sanctions, and fair work standards. Dropshipping Legal Compliance means you must look at all these laws before you start selling. If you are not sure, talk to a legal expert. This helps you stay out of trouble and keeps your shop safe.

Tip: Always look at the newest rules in your country and where you want to sell. Laws can change fast, especially for online shops.

Key Regulations

Dropshipping Legal Compliance got harder in 2025. New tariffs and strict rules now affect your shop. Here are some changes you should know:

The US put a 10% tariff on Chinese goods in February. Tariffs on goods from Mexico and Canada went up to 25%.

In March, tariffs rose again: 20% on Chinese goods, 25% on Canadian and Mexican goods, plus extra charges on steel, aluminium, and cars.

In April, the US said there was an economic emergency. China got tariffs up to 145% and export limits on rare earths.

May had some deals, but threats of 50% tariffs on EU goods stayed.

In June, steel and aluminium tariffs went up to 50%, with some short breaks.

July made tariff deadlines longer and threatened up to 50% tariffs on 25 trade partners.

You must also follow new rules about product legality, business registration, and tax. You need to register your shop for tax and payments. You must pay sales, income, and international taxes. These changes mean you may pay more for goods and shipping. You might need new suppliers or change your prices. Dropshipping Legal Compliance now means you must watch for new laws and change quickly.

Platform Rules

Every selling platform has its own dropshipping rules. You must follow these to avoid bans or fines. Here is a quick look at the main platforms in 2025:

Platform | Key Dropshipping Rules in 2025 |

|---|---|

Amazon | - You must be the only seller listed. |

eBay | - You must own stock or have a deal with a proper wholesale supplier. |

Shopify | - No strict dropshipping rules. |

You need to read each platform’s dropshipping rules. Dropshipping Legal Compliance means you must check these before you list goods. If you break the rules, you could lose your shop or face legal trouble. Always keep supplier deals clear and make sure your name is on all paperwork. Keep customer data safe and send orders on time.

Note: Platforms change their rules often. Set reminders to check policies every few months.

International Laws

When you run a dropshipping business across borders, you face a maze of international laws. In 2025, these rules have become tougher and more complex. You cannot ignore them if you want your shop to survive.

You must follow the laws in your own country and in every country where you sell. This means you need to check product safety, consumer protection, and tax rules for each market. If you skip these steps, you risk fines, customs delays, or even losing your right to sell.

Here are some key changes you need to know:

The de minimis exemption for Chinese imports has ended. Now, even small parcels from China face tariffs. This makes small-batch importing more expensive and risky.

Tariffs on goods from China, Mexico, and other countries have gone up. You may pay more for popular products, which can hurt your profit margins.

Many dropshippers now look for suppliers in Mexico, Vietnam, or India to avoid high tariffs on Chinese goods.

Customs checks have become stricter. You may need more paperwork and certificates. Delays at the border are now common.

New VAT and tax rules mean you must register and declare sales in each country where you have customers. This adds more admin work for you.

Stronger consumer protection laws demand clear delivery times, longer return windows, and honest product descriptions.

Countries have cracked down on counterfeit and unsafe goods. If you sell fake or non-compliant products, customs can seize your stock and fine you.

Sanctions and embargoes can block you from trading with certain countries. You must check these lists before you pick suppliers or markets.

Tip: Work with suppliers who understand international rules. They can help you get the right documents and avoid customs problems.

You also need to know about global trade agreements and organisations. These groups set the rules for tariffs, trade, and business standards:

Organisation | What They Do |

|---|---|

WTO | Sets trade agreements and solves disputes between countries. |

ICC | Creates business standards and contract rules. |

WCO | Sets customs standards for shipping and importing. |

IMF | Keeps financial stability in global trade. |

Dropshipping Legal Compliance now means you must stay alert. Laws change fast, especially for cross-border sales. You need to check for new tariffs, tax rules, and shipping laws every few months. If you want to avoid fines and delays, you must keep your paperwork in order and work with trusted partners.

Note: Dropshipping Legal Compliance is not just about following your local laws. You must also respect the rules in every country where you sell. This keeps your business safe and helps you build trust with customers worldwide.

Trademarks & IP

Trademark Risks

You might think selling trending products is easy, but trademark risks can catch you out fast. If you sell goods with someone else’s brand name or logo without permission, you could face big trouble. Many dropshippers get into hot water by listing products that look like famous brands. Sometimes, suppliers send you items with fake logos or packaging. If you do not check, you could end up selling counterfeits.

Trademark owners watch online shops closely. They report sellers who use their names or logos without a licence. Platforms like Amazon and eBay will suspend your account if you break trademark rules. You could also get legal letters or even face court. Protect your shop by checking every product for brand names, logos, or marks that belong to someone else.

Tip: If you are not sure about a product, ask the supplier for proof that they can use the brand name or logo.

Copyright Issues

Copyright problems often pop up in dropshipping, especially in your product listings and adverts. You might use images, text, or videos from the internet to make your shop look good. But if you use these without permission, you could break the law. Here are some common ways copyright issues arise:

Using product photos or videos you find online without asking the owner.

Copying product descriptions or marketing text from other shops.

Selling goods with copyrighted logos or branding, sometimes by accident through your supplier.

Using music or clips in adverts that you do not have rights to.

Not checking if your supplier has the right to use certain images or branding.

If you break copyright rules, you could face fines, lose your shop, or damage your reputation. Always use your own photos or buy licences for images and music. Check your supplier’s materials before you post them.

Avoiding Infringement

Supplier Vetting

You can avoid most IP problems by picking the right suppliers. Start by checking their track record. Look for reviews and see if they have a history of selling real, legal products. Ask for product samples so you can check quality and branding. Reliable suppliers will show you certificates or proof that their goods are genuine.

Choose suppliers with good reviews and a clean record.

Ask for samples to check for fake logos or poor quality.

Make sure your supplier can prove they have the right to use any brand names or images.

Include clear IP rules in your supplier contracts.

Trademark Searches

Before you list a new product, do a quick trademark search. You can use free online tools to check if a brand name or logo is registered. If you spot a trademark, do not list the product unless you have permission. This step saves you from legal trouble and keeps your shop safe.

Search for trademarks using official databases.

Check product packaging and listings for brand names or logos.

Ask your supplier for written proof if you are unsure.

Avoid products that look like copies of big brands.

Review your listings often to catch any problems early.

Note: Staying alert and doing your homework helps you avoid costly mistakes. Protect your shop and build trust with your customers by respecting trademarks and copyrights.

IP Protection

Brand Registration

You want your shop to stand out and stay safe. Registering your brand is a smart move. When you register your brand, you get legal rights over your shop name, logo, and even your slogans. This stops others from copying your style or using your name to sell their goods.

Here’s how you can protect your brand:

Pick a unique name and logo for your shop.

Register your trademark with the right office in your country, like the UK Intellectual Property Office.

Use your trademark on your website, packaging, and marketing.

Keep records of your brand use and registration papers.

Add your trademark to your supplier agreements, so they know you own it.

If you sell branded goods, always get written permission from the brand owner. Never list products with someone else’s logo unless you are an authorised reseller. Prefer unbranded or white-label products if you want to avoid trouble. You should also include trademark-compliance clauses in your supplier contracts. This makes sure everyone knows who owns what and who is responsible if something goes wrong.

Tip: Always check official trademark databases before you launch a new product or brand. This helps you avoid legal fights and keeps your shop safe.

Handling Complaints

Sometimes, you might get a complaint about your products or your brand. Maybe someone says you copied their logo or used their photos. Don’t panic. You can handle these complaints if you have a plan.

Here’s what you should do:

Respond quickly and politely to any complaint.

Check your records to see if you have the right to use the brand or image.

If you made a mistake, remove the product or image straight away.

Talk to your supplier and ask for proof of rights if the problem came from them.

Keep all emails and documents about the complaint.

You should also add clear rules in your shop’s Terms & Conditions. Tell users what they can and cannot do with your branding. If someone breaks these rules, you can suspend or ban them from your shop. This protects your business and shows you take IP rights seriously.

Note: If you get a legal letter or a takedown notice, talk to a lawyer. They can help you fix the problem and avoid bigger trouble.

Platform IP Policies

Every big e-commerce platform has its own way of protecting intellectual property. You need to know these rules if you want to keep your shop open and avoid bans.

Here’s a quick look at how platforms enforce IP policies:

Enforcement Aspect | Description |

|---|---|

DMCA Compliance | Platforms use takedown systems and ban repeat offenders to protect copyright holders. |

Automated Monitoring Tools | AI checks listings for fake logos or stolen images in real time. |

Human Moderation | Staff review flagged content to make sure the rules are fair and clear. |

Seller Education and Support | Platforms give guides and tips to help you follow the rules. |

Transparent Takedown Process | You can report problems easily, and platforms act fast to fix them. |

Community Accountability | Users can report fake or stolen content, helping keep the marketplace safe. |

Policy Communication | Platforms update you with new rules through guides, FAQs, and emails. |

Global Legal Adaptation | Rules change to match local laws, like the EU Digital Services Act. |

Continuous Policy Evolution | Platforms update their rules often to keep up with new risks and feedback. |

You should read the IP policies for each platform you use. Stay updated, follow the rules, and always keep your shop’s records in order. This helps you avoid sudden bans and keeps your business running smoothly.

Remember: Protecting your brand and following platform rules builds trust with your customers and keeps your shop safe.

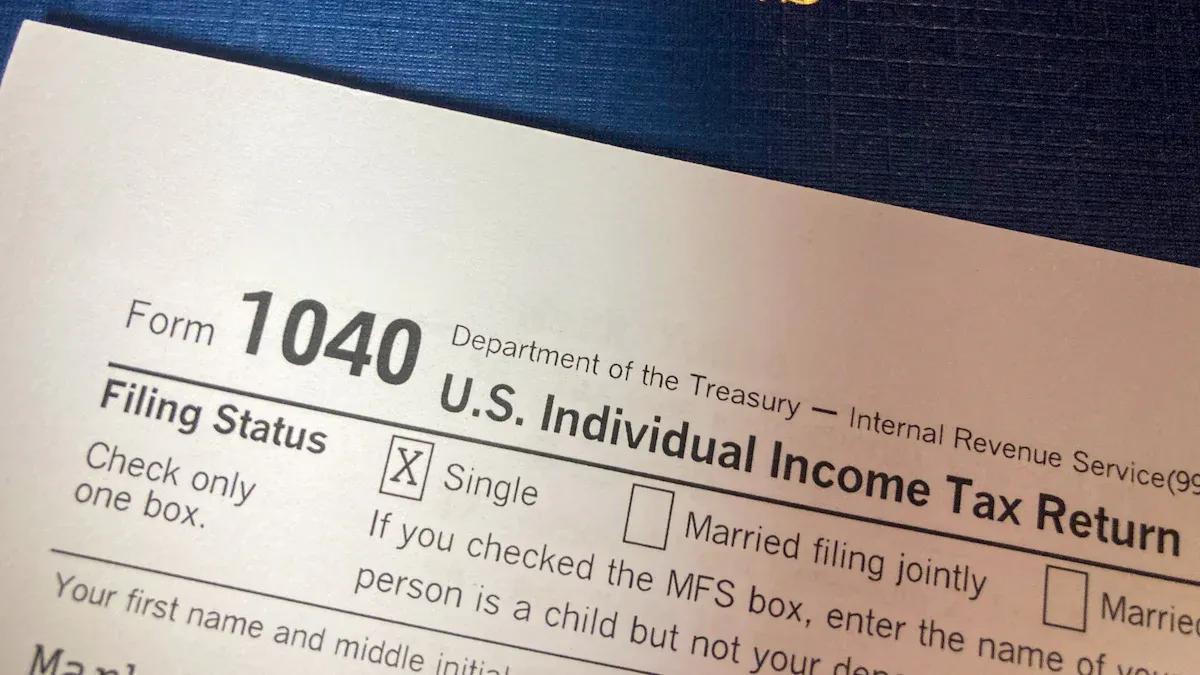

Tax Compliance

Sales Tax & VAT

You cannot run a dropshipping business in 2025 without thinking about sales tax and VAT. These taxes can get confusing, especially if you sell to customers in different countries. Let’s break down what you need to know.

UK VAT

If you sell to customers in the UK, you must follow the latest VAT rules. After Brexit, the UK made changes that affect all dropshippers, even if you live outside the UK. You must register for VAT with HMRC if you sell goods to UK customers. If your consignment is worth £135 or less, you must charge VAT at the point of sale. For goods over £135, VAT is paid at import.

The standard VAT rate in the UK is 20%. Some goods have a reduced rate of 5%, and a few are VAT-free. You need to keep good records and file VAT returns on time. If you do not follow these rules, you could face fines or lose your right to sell in the UK.

EU VAT

Selling to customers in the European Union brings its own set of VAT rules. Each EU country has its own VAT rate, usually between 17% and 21%. You must register for VAT if your sales to a country go over that country’s threshold. For small parcels (up to €150), you can use the IOSS scheme. This lets you collect VAT at checkout and makes customs easier.

Import VAT applies to goods over €10–22, depending on the country. You must report and pay VAT to the right tax office. The rules can change, so check them often. If you do not follow EU VAT rules, customs may hold your goods or charge extra fees.

US Sales Tax

Sales tax in the United States works differently. There is no federal sales tax. Each state sets its own rules and rates. Since the South Dakota vs. Wayfair case, you do not need a physical shop in a state to owe sales tax. If your sales in a state go over $100,000 or you have more than 200 transactions there in a year, you must register and collect sales tax.

Sales tax rates vary a lot. For example, California charges 7.25%, but Delaware has no sales tax. You must check each state’s rules before you start selling. Some states want you to collect tax even if you only sell online. If you ignore these rules, you could get fined or banned from selling.

Here’s a quick table to help you compare:

Region | Tax Type | Key Requirements and Rules | Rates and Thresholds |

|---|---|---|---|

United States | Sales Tax | State-level only. Nexus rules mean you may owe tax without a shop in the state. Register if sales >$100,000 or 200 orders. | Rates vary by state (e.g., California 7.25%, Delaware 0%). |

European Union | VAT | Import VAT on goods over €10–22. Register for VAT if sales exceed country thresholds. IOSS for imports up to €150. | VAT rates 17%–21%. Thresholds and rules differ by country. |

United Kingdom | VAT | Overseas sellers must register for VAT. Charge VAT at sale if consignment ≤ £135; otherwise, VAT at import. | Standard rate 20%, reduced 5%, some goods VAT-free. |

Tip: Tax rules change often. Check the latest updates before you start selling in a new country.

Income Tax

You must also pay income tax on your dropshipping profits. This is separate from sales tax or VAT. Income tax rules depend on where you live and where your business is registered.

Business Registration

You need to register your dropshipping business with the right tax office. This could be HMRC in the UK, the IRS in the US, or the local tax office in the EU. Registration gives you a tax ID number. You must use this number when you file your taxes.

If you do not register, you could face big fines. Some platforms will also ban your shop if you cannot prove you are a real business. Registration also helps you claim business expenses and stay legal.

Record-Keeping

Good record-keeping is key for tax compliance. You must keep track of all your sales, expenses, and tax payments. This includes invoices, receipts, and bank statements. If you mix personal and business money, you could get in trouble during an audit.

The IRS in the US now wants platforms to report payments over $600 a year. This means you must report all your income, even small amounts. If you miss deadlines or underreport, you could face audits or lose your shop.

Here’s a table to show the main income tax obligations:

Tax Type | Description & Obligations | Estimated Range / Notes |

|---|---|---|

Federal Income Tax | Pay tax on profits. Self-employment tax applies if you work for yourself. | |

Sales Tax | Collect and pay sales tax in states or countries where you have nexus. | 0%–11% in the US, varies elsewhere. Platforms may collect for you. |

Source Tax | Pay tax to suppliers on product costs. | Around 10% of product price. |

Import Duties | Pay when importing goods from abroad. | 0%–37%, average about 5%. |

Registration & Reporting | Register for tax numbers and report income, even if not profitable. Keep clear records. | Needed for compliance and audits. |

Tax Reduction Methods | Deduct business expenses (ads, fees, shipping) and use tax exemption certificates if allowed. | Helps lower your taxable income. |

Note: Always keep your business and personal finances separate. This makes tax time much easier.

Tax Nexus

Tax nexus is a key idea in dropshipping. Nexus means a link between your business and a place that makes you owe tax there. You can create nexus in many ways, like having a warehouse, staff, or lots of sales in a state or country.

If you have nexus in a state, you must register, collect, and pay sales tax there. Some states count your supplier’s location as nexus. Others look at your sales numbers. For example, if you use Amazon FBA, storing goods in their warehouses can give you nexus in many states.

Here are some things that can create nexus:

Physical presence (office, warehouse, staff)

Economic activity (sales over a set amount)

Inventory stored in a state (like with Amazon FBA)

Affiliates or partners in a state

Dropshipping relationships

If you have nexus, you must:

Register for a sales tax permit in that place

Collect sales tax from buyers based on where they live

File sales tax returns on time

States and countries have different rules. Some tax the wholesale price, others the retail price. If you lose nexus, you may still need to collect tax for a while. Always check the rules for each place you sell.

Tip: Track where you have nexus. Use software or a spreadsheet to keep up with changing rules. This helps you avoid fines and keeps your business safe.

International Tax

Selling to customers in other countries sounds exciting, but international tax rules can trip you up fast. You need to know about VAT, customs duties, and sales tax systems that change from one country to another. If you ignore these, you could face big fines or upset customers.

When you ship goods from outside the EU, for example, your customer might have to pay VAT and customs duties when the parcel arrives. Sometimes, low-value items get an exemption, but most goods do not. The rules keep changing, so you must stay alert. The VAT Act and customs laws mean you and your customers both have tax responsibilities, no matter where you live.

You also need to watch out for different tax systems. The EU uses VAT, but countries like New Zealand and Canada use GST. Each country sets its own rules and thresholds. If you sell a lot in a country, you might need to register for VAT or GST there. If you miss this step, you could get hit with penalties.

Here are some common problems dropshippers face with international tax:

You forget to add VAT or customs duties, so your customer gets a surprise bill.

You do not check the tax rules for each country, which leads to legal trouble.

You do not use tools to collect the right taxes at checkout, so you pay out of pocket later.

You do not tell customers about possible extra charges, which hurts your reputation.

Tip: Always research the tax and duty rules for every country you ship to. Use automated tools to collect the right taxes at checkout. This keeps you and your customers happy.

If you want to avoid mistakes, follow these steps:

Check if you need to register for VAT or GST in each country based on your sales.

Tell your customers about any extra charges they might face.

Use e-commerce platforms or plugins that help you collect and pay the right taxes.

Keep up with changes in international tax laws, as they can change quickly.

International tax can feel overwhelming, but you can manage it with the right tools and planning. Stay organised, keep learning, and always put your customers first.

Compliance Steps

Accounting Tools

You do not have to do everything by hand. Good accounting tools can save you time and help you avoid mistakes. These tools track your sales, expenses, and taxes automatically. You can see your profits, spot trends, and make better decisions.

Here are some ways accounting software helps you:

It records every sale and expense, so you do not miss anything.

It creates reports that show how your business is doing.

It helps you collect and pay the right taxes in each country.

It keeps your financial data safe with encryption and backups.

It reduces errors and keeps your records tidy for audits.

Some popular accounting tools for dropshippers include Xero, QuickBooks, and specialised dropshipping apps. Many e-commerce platforms also offer built-in tax and accounting features. You can connect these tools to your shop and automate most of your bookkeeping.

Note: Always choose software that matches your business size and needs. Look for tools that update with new tax rules and support the countries where you sell.

Professional Advice

Even with the best tools, you might need expert help. Tax laws change often, and every country has its own rules. A good accountant or tax adviser can guide you through the tricky parts. They help you register your business, file your taxes, and plan for the future.

Here’s why professional advice matters:

You get help understanding nexus laws and when you need to register for tax.

You learn how to set up your business the right way from the start.

You avoid costly mistakes and penalties by filing taxes on time.

You get tips on how to save money and reduce your tax bill.

You stay up to date with new laws and changes in your markets.

If you feel lost or unsure, do not wait. Reach out to a tax professional who knows about e-commerce and dropshipping. They can save you time, money, and stress.

Taking these steps keeps your dropshipping business safe and legal. With the right tools and advice, you can focus on growing your shop and serving your customers.

Returns & Refunds

Legal Obligations

When you run a dropshipping shop, you must follow the law for returns and refunds. Each region has its own rules. If you sell to customers in the UK, EU, or US, you need to know what is required.

UK Law

In the UK, you must follow consumer protection laws. Customers who buy online usually have a right to return goods within 14 days of receiving them. This is called the "cooling-off period." You must give a full refund if the customer returns the item in this time. Some items, like personalised goods or perishable products, do not qualify. You must tell your customers about their rights and display your return policy clearly on your website.

EU Law

The EU has strict rules for online shops. Here is a quick summary:

Rule | What You Must Do |

|---|---|

Let customers return goods within 14 days for any reason. | |

Two-year guarantee | Fix or replace faulty goods for up to two years. |

Clear policy | Show your return and refund policy on your website. |

Exceptions | List items that cannot be returned, like custom goods or digital content. |

Shipping costs | Tell customers who pays for return shipping. |

Professional status | Say if you are a business or private seller. |

If you do not follow these rules, you could face fines or lose customer trust.

US Law

The US does not have a single federal law for returns. Each state sets its own rules. Some states require you to accept returns, while others do not. Most big platforms, like Amazon, ask you to offer at least a 30-day return window. You should always check the rules for each state where you sell.

Tip: Always make your return policy easy to find. Put it in your website footer and at checkout.

Return Process

Returns in dropshipping can get tricky. You need a clear plan to keep things simple for your customers.

RMA Procedures

An RMA (Return Merchandise Authorisation) is a code or form you give to customers who want to return an item. This helps you track returns and stops confusion. Here is how you can set up your RMA process:

Customer contacts you to request a return.

You check if the item qualifies for return.

You give the customer an RMA number and return instructions.

Customer sends the item back, either to you or your supplier.

You or your supplier check the item and approve the refund.

Some platforms, like Shopify, let you use apps to automate this process. This saves time and reduces mistakes.

Supplier Coordination

You must work closely with your suppliers. Their return policy often decides what you can offer your customers. Always check:

How long your supplier gives for returns.

If they charge restocking fees.

Who pays for return shipping.

If your supplier is slow or strict, you may need to match their policy to avoid losing money. Good communication with your supplier helps you solve problems quickly.

Return Policies

A clear return policy builds trust. It also protects your business from disputes.

Customer Communication

You should tell your customers:

How long they have to return an item (usually 14 or 30 days).

What condition the item must be in (unused, in original packaging).

How to start a return (contact you, fill out a form, or use an app).

Who pays for return shipping.

How and when they will get their refund.

Use simple language. Put your policy in your website footer, FAQ, and at checkout. This helps customers feel safe when they buy from you.

Dispute Handling

Sometimes, things go wrong. Maybe a customer says they never got their refund, or the item was not as described. You need a plan for these cases:

Respond quickly and politely.

Check your records and talk to your supplier if needed.

Offer a fair solution, like a replacement or refund.

Keep notes of all messages and actions.

Remember: A fair and clear return policy keeps your customers happy and your business safe.

Platform Return Rules

You might wonder how big e-commerce platforms handle returns for dropshipping shops. They set strict rules to protect buyers and keep sellers honest. If you want to sell on sites like Amazon, eBay, Shopify, or AliExpress, you must follow their return policies.

Most platforms ask you to offer clear, easy-to-understand return policies. They know that about 30% of online orders get returned, much higher than in physical shops. Customers like simple returns. In fact, 92% say they will buy again if the process is easy. Nearly 67% check your return policy before they buy. If your rules are confusing, you could lose sales.

Platforms want you to:

Set a clear return window, like 10, 14, or 30 days after delivery.

Explain what condition the product must be in. Most want items unused, in original packaging, with safety seals.

Tell customers who pays for return shipping. Sometimes you pay, sometimes the buyer does.

List any restocking fees or special rules for final sale or perishable goods.

Process refunds quickly, often within 30 days of getting the item back.

Use automated tools to approve or reject returns, spot fraud, and track patterns.

AliExpress, for example, lets buyers request a refund within 10 days. They must open a dispute, get a free return label, and send the item back. Refunds come within 30 days. Shopify and Amazon have similar steps. You can customise your policy, but you must match supplier terms and platform rules.

Platforms also help you manage returns from different suppliers. You can route returns to the right place and use central systems to track everything. Data analytics show you which products get returned most. If you see a problem, you can stop selling that item or switch suppliers.

Customer service matters too. Platforms want you to train your team to handle returns well. Clear communication builds trust and keeps buyers happy.

Tip: Always check your platform’s latest return rules. Update your shop policy to match. This helps you avoid disputes and keeps your account safe.

Data Protection

You must protect customer data during the return process. Platforms and laws require you to keep personal details safe. When a buyer sends back an item, you collect names, addresses, and sometimes payment info. You must store this data securely and only use it for the return.

Here are some steps you can take:

Use encrypted systems to store customer details.

Limit access to data. Only staff who need it should see it.

Delete personal data after the return is complete.

Never share customer info with suppliers unless needed for the return.

Follow GDPR rules in the UK and EU. These laws say you must tell buyers how you use their data.

If you break data protection rules, you could face big fines or lose your shop. Customers trust you with their details. Show them you care by keeping data safe.

Note: Always update your privacy policy to cover returns and refunds. Tell customers how you handle their data. This builds trust and keeps you legal.

Compliance Steps

Legal Audits

You want your dropshipping business to stay safe and legal. Regular legal audits help you spot risks before they become problems. Think of an audit as a health check for your shop. You look at every part of your business to make sure you follow the rules.

Here’s a simple way to run a legal audit:

Vet your suppliers. Check if they are real, have the right certificates, and deliver on time.

Keep records of every transaction and message. This helps if you face a dispute or an audit.

Write clear legal agreements with suppliers and partners. These contracts should cover product quality, shipping, payments, and data privacy.

Register your business properly. Pick the right type, like sole trader or limited company, and get all licences.

Manage your taxes. Make sure you collect and pay sales tax, income tax, and VAT where needed.

Get insurance. General liability insurance protects you if something goes wrong.

Be open about your terms. Show clear policies for returns, refunds, and delivery times.

Protect your brand. Register trademarks and watch for anyone copying your name or logo.

Ask a legal expert for advice. They can help with tricky rules in your country.

Review your contracts and processes often. Update them if laws change.

Tip: Run a legal audit every few months. This keeps your business strong and ready for anything.

Regulatory Updates

Rules for dropshipping change quickly. You need to keep up or risk falling behind. Many shop owners forget to check for new laws, but this can lead to fines or lost sales.

You should update your compliance procedures at least every quarter. If there’s a big change in the law, update your process straight away. Regular reviews help you spot new risks and fix them before they hurt your business.

Check for updates every three months.

Watch for news about tariffs, taxes, and consumer protection.

Sign up for legal newsletters or join webinars to learn about new rules.

Talk to your accountant or legal adviser if you hear about changes.

Note: Staying updated means you can act fast and keep your shop safe.

Staff Training

Your team needs to know the rules too. Good training helps everyone work better and keeps your business out of trouble. You want your staff to understand dropshipping, not just regular shop work.

Here are some ways to train your team:

Teach staff about data protection. Show them how to keep customer details safe.

Train customer service reps to handle questions and returns. This stops disputes and chargebacks.

Use fraud detection tools. Teach your team how to spot fake orders or scams.

Keep in touch with suppliers. Make sure everyone knows how to check product quality and delivery times.

Explain the difference between dropshipping and normal fulfilment.

Go over key regulations and contract rules.

Show staff how to use dropshipping software and tools.

Prepare your team for problems, like late deliveries or faulty goods.

Run training sessions often. Update them when rules change.

Remember: A well-trained team helps your business run smoothly and keeps you compliant. Regular training builds confidence and trust.

Legal Resources

You do not need to deal with dropshipping compliance by yourself. There are many legal resources that can help keep your business safe and current. Here are some good places to get support.

Official Product Safety and Recall Resources

Each country has its own product safety rules. You must check these before selling new items. If you sell in more than one country, use the correct website for each place.

Product Safety Guidance:

United Kingdom: Product safety advice for businesses

European Union: EU product safety

United States: CPSC for businesses

Canada: Product safety

Australia: Product safety

New Zealand: Product safety

Product Recall Alerts:

United Kingdom: RAPEX

United States: Recalls.gov

Canada: Recalls and safety alerts

ASEAN: Product alerts

OECD: Global recalls portal

Tip: Always look at recall lists before adding a new product. This helps you avoid selling goods that are not safe.

Refund and Return Policy Help

You must follow the refund and return laws in each country. The rules are different everywhere. Here are some useful links:

United Kingdom: Accepting returns and giving refunds

European Union: EU guarantees and returns

United States: FTC online shopping rules

Canada: Refund and exchange policies

Australia: Repair, replace, refund

New Zealand: Customer returns and complaints

Why Use Legal Resources?

Dropshipping has many risks. You must follow truth in advertising laws, pay the right taxes, and respect copyright and trademarks. If you skip these steps, you could get fined or lose your shop. Legal resources help you:

Check product safety and recall alerts.

Write clear refund and return policies.

Learn about tax and licensing rules.

Avoid copyright and trademark issues.

Keep up with new laws.

Professional Support

Sometimes, you need more than just websites. A tax adviser or solicitor can help with hard rules. They can check your contracts, help you register your business, and explain international laws. You should also:

Check your suppliers carefully.

Get product liability insurance.

Use a checklist for licences, taxes, and consumer protection.

Note: Laws change quickly. Set a reminder to check your resources and talk to a professional every few months.

Using the right legal resources keeps your dropshipping business safe and trusted. You can focus on growing your shop, knowing you have good support.

You can keep your dropshipping shop safe by doing some simple things. Always check your suppliers before you work with them. Do not forget about shipping laws or customs rules. These rules can change fast, so pay attention. Make sure you have clear deals with your suppliers and clear rules for your shop. If you are unsure, ask a lawyer or tax expert for help. Dropshipping Legal Compliance is not something you do just once. Keep learning new things, act honestly, and look after your shop every day.

Be ready and careful—your future success relies on this!

FAQ

What is dropshipping and is it legal in 2025?

You only buy products after someone orders them. Dropshipping is allowed in 2025. You must follow rules for taxes and trademarks. You also need to protect customers. Always check new laws before you start selling.

Do I need to register my dropshipping business?

Yes, you must register your business. This helps you pay the right taxes. It also helps you follow local laws. Registration makes customers and platforms trust you.

How can I avoid trademark problems?

Always check if a product has a brand name or logo. Ask your supplier for proof they can use it. Search for trademarks online before you list anything. This keeps your shop safe.

What taxes do I need to pay?

You must pay sales tax, VAT, and income tax. The rules are different in each country and state. Use accounting tools to track your taxes. Ask a tax adviser if you are unsure.

What should my return policy include?

Clear return window, like 14 or 30 days

Rules for item condition

Steps for starting a return

Who pays for shipping

How refunds work

A simple policy helps build trust and keeps you legal.

How do I protect customer data during returns?

You should use secure systems to store customer details. Only let staff who need it see personal data. Delete information after the return is finished. Always follow GDPR and privacy laws.

Where can I find help with dropshipping compliance?

Resource Type | Where to Look |

|---|---|

Legal Advice | Local solicitor, online legal forums |

Tax Guidance | HMRC, IRS, official government websites |

Product Safety | National product safety portals |

Platform Support | Seller help centres (Amazon, eBay, Shopify) |

Tip: Check these resources every few months for updates.

TangBuy: A Smarter Way to Dropship in 2025

If you're looking to stay competitive with dropshipping in 2025, speed and trend-awareness are key. TangBuy helps you stay ahead with real-time product trends, fast fulfilment, and factory-direct sourcing. With over 1 million ready-to-ship items, 24-hour order processing, and seamless Shopify integration, TangBuy makes it easier to test, scale, and succeed in today's fast-moving eCommerce landscape.

See Also

Profitable Dropshipping Concepts To Try In The Year 2025

Understanding The Real Expenses Of Dropshipping In 2025

Complete Stepwise Plan To Start Dropshipping Business In 2025

Most Lucrative Dropshipping Markets To Explore In 2025

Essential eBay Dropshipping Advice For Sellers To Succeed 2025