Essential Tips for Managing Finances in Your Dropshipping Business

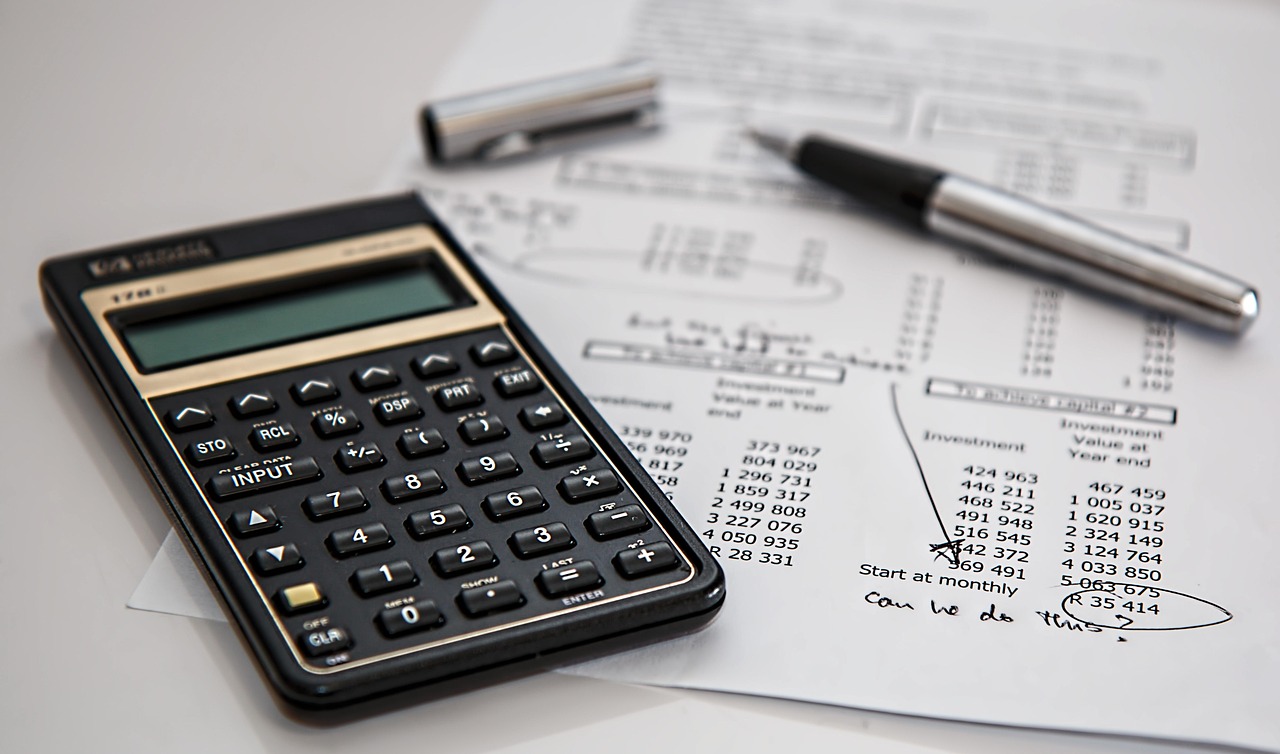

If you have a dropshipping business, handling money is very important. Good money skills can help your business do well. You must keep your business and personal money apart. If you mix them, it gets confusing quickly. Dropshipping has its own problems. You might have trouble with:

Cash flow, because you wait for money but must pay for stock and ads

High costs to get customers and fees for payment gateways

Inventory management and shipping costs that change

Risks like credit card fraud, bad suppliers, and market changes

Managing Finances well helps you see problems early. It also keeps your business working well. Take some time to check how you use your money now. Are you doing well, or do you need a better way?

Key Takeaways

Keep your business money and personal money apart. Use a business bank account to stay organised. This helps protect your things.

Track every pound you get and spend. Use accounting software or simple records. This helps you know your profits and avoid surprises.

Make a clear budget for your business. Start with a small marketing spend. Change your plan if something works well. This helps your business grow wisely.

Watch your cash flow all the time. Check payments, costs, and sales often. This keeps your business running well. You will not run out of money.

Use automation tools and bookkeeping software. These save you time and lower mistakes. You can see your money details right away.

Set clear financial goals for your business. Check important numbers like profit margins and customer costs often. This helps you find problems and new chances to grow.

Know your tax duties and keep your records tidy. This helps you avoid fines and makes tax time easier. Ask a professional for help if you need it.

Stay flexible and learn new skills. Try new products and change your plans if needed. This keeps your dropshipping business strong and growing.

Financial Management Basics

Why It Matters

You might wonder why you should care so much about financial management in your dropshipping business. The truth is, handling your money well keeps your business alive and growing. When you manage your finances, you can spot problems early, like cash running low or costs getting out of hand. This helps you make smart choices before things get serious.

Good financial management also helps you set the right prices. You need to know your supplier costs, shipping fees, and marketing spend. If you don’t, you might set prices too low and lose money, or too high and lose customers. When you track your money, you can see which products make you the most profit and which ones drain your cash.

Here are some basic principles you should follow:

Understand what assets, liabilities, capital, revenue, and expenses mean for your business.

Keep your business and personal accounts separate.

Track every pound that comes in and goes out.

Use accounting software made for e-commerce to save time and avoid mistakes.

Check your balance sheets and financial statements often to see how healthy your business is.

Tip: Many successful dropshipping businesses use tools like QuickBooks Online or Xero to automate bookkeeping and keep everything organised.

Risks of Poor Practice

If you ignore your finances, you put your business at risk. Many new businesses fail because they run out of cash or don’t keep track of their spending. Dropshipping comes with its own set of dangers. You might face hidden costs, like fees for inventory tools or order syncing. These can eat into your profits fast.

You also have to watch out for unreliable suppliers. If a supplier doesn’t deliver or sends fake products, you could lose money and damage your reputation. Handling returns and refunds can get messy, especially if you work with many suppliers who all have different rules. Payment gateway problems, like failed transactions or security issues, can lead to lost sales and extra work.

Other risks include:

Low profit margins from high shipping costs and returns.

Poor inventory management causing overselling or stock shortages.

Legal trouble if you don’t handle taxes or follow the rules.

Key Benefits

When you manage your finances well, you give your business the best chance to succeed. Here’s what you gain:

You always know how much money you have, so you can pay bills and suppliers on time.

You set clear financial goals and make better decisions about spending and saving.

You spot growth opportunities, like adding new products or investing in better tools.

You keep your costs under control, which means more profit for you.

You avoid nasty surprises, like tax fines or sudden cash shortages.

You build a business that can grow and adapt, even when the market changes.

Managing your finances isn’t just about avoiding problems. It’s about giving yourself the freedom to grow, try new things, and build a dropshipping business that lasts.

Separating Business and Personal Finances

Keeping your business money separate from your personal money is one of the smartest things you can do as a dropshipper. It makes your life easier and protects you from big problems down the road. Let’s look at how you can do this well.

Business Bank Accounts

You need a business bank account for your dropshipping store. This is not just about being organised—it’s about protecting yourself and your business. When you use a separate account, you show everyone that you run a real business. Customers, suppliers, and even banks trust you more when they see you keep things professional.

Here’s why a business bank account matters:

It keeps your personal savings safe if your business faces debts or legal trouble.

You get clear records for all your business income and expenses.

It helps you apply for business loans or credit cards more easily.

You look more credible to investors and partners.

If you mix your personal and business money, you risk losing legal protection. Courts might say your business is not separate from you. This means your personal assets, like your house or car, could be at risk if something goes wrong.

Setting up a business bank account is simple. Many banks in the UK, such as Tide, let you open an account online without a meeting. Some even offer perks like cashback. Look for an account with no monthly fees and a good digital platform. Use this account only for business payments—receiving customer money and paying suppliers.

Tip: Always use your business account for dropshipping transactions. This keeps your records clean and helps you avoid confusion at tax time.

Record Keeping

Good record keeping is the backbone of your financial health. You need to track every pound that comes in and goes out. This helps you see if your business is making money or losing it.

Here’s how you can keep your records in top shape:

Record every sale and every expense as soon as it happens.

Keep all receipts, invoices, and supplier details in one place.

Use accounting software like QuickBooks or Xero to automate your bookkeeping. These tools connect to your bank account and make tracking easy.

Review your profit and loss statements, balance sheets, and cash flow reports regularly.

Choose a bookkeeping system that fits your business. Single-entry works for small shops, but double-entry is better if things get busy.

If you keep your business and personal finances separate, your records stay clear. This makes tax time less stressful and helps you spot problems early. You also avoid missing out on tax deductions because you can prove which expenses are for your business.

Keeping good records and a separate bank account gives you peace of mind. You know where your money goes, and you stay ready for anything—taxes, audits, or new opportunities.

Business Costs

Product and Supplier Fees

You need to know what you pay for products and suppliers in dropshipping. Most of the time, you do not pay extra supplier fees when you use platforms like AliExpress. You only pay for the products you order. This makes it easy to start because you do not face big upfront costs. However, if you want to test products before selling, you might spend about $200 to sample 1-2 items from each supplier. This helps you check quality and avoid unhappy customers.

Some supplier directories charge monthly or one-time fees. Here’s a quick look:

Supplier Platform | Fee Type | Fee Range / Amount |

|---|---|---|

SaleHoo | Monthly Subscription | $27 to $97 per month |

Wholesale2B | Monthly Subscription | $37.99 to $49.99 per month |

Worldwide Brands | One-time Fee | $299 lifetime access |

Shipping costs can change a lot. For example, ePacket shipping might cost between $7 and $27, while AliExpress Standard Shipping is usually under $5. Always check these costs before you set your prices.

Tip: Set aside 5-10% of your monthly sales to cover returns and refunds. This helps you handle problems without hurting your cash flow.

Platform and Transaction Fees

Running a dropshipping store means you pay fees to use e-commerce platforms and payment gateways. These costs can add up, so you need to plan for them. Most platforms charge a monthly fee. For example, Shopify plans start at $39 and can go up to $399 per month. BigCommerce and ShopBase have similar price ranges.

Marketplaces like Amazon and eBay have their own fees. Amazon charges a $40 subscription plus 8%-15% commission on each sale. eBay lets you list up to 250 items for free, then charges $0.35 per extra item and a 3%-15% commission. Payment processing fees, like those from PayPal or Stripe, usually take 2.9% plus $0.30 per sale. If you use a third-party payment gateway, you might pay an extra 0.5%-3% per transaction.

Fee Type | Examples / Details |

|---|---|

Platform Fees | Shopify ($39-$399), BigCommerce ($30-$300), ShopBase ($19-$249) |

Marketplace Fees | Amazon: $40 + 8%-15% commission; eBay: $0.35/item + 3%-15% commission; Facebook: 5% commission |

Payment Processing | 2.9% + $0.30 per transaction; extra 1%-2.5% for cross-border payments |

Third-party Gateways | 0.5%-3% transaction fee if not using in-house payment provider |

These fees can take a big bite out of your profits, so always include them in your budget.

Marketing Spend

Marketing is one of your biggest costs in dropshipping. You need to spend money to get customers to your store. The amount you spend depends on your business size. If you run a large dropshipping business, you might spend $5,000 to $10,000 a month on marketing. This could be up to half your total budget. For a mid-sized business, marketing might take 20% to 40% of your budget. If you run a small, home-based shop, you might spend $400 to $800, which is about 13% to 27% of your budget.

Business Scale | Total Budget Range | Marketing Spend Range | Marketing % of Total Budget |

|---|---|---|---|

Large-Scale Dropshipping | $15,000 - $30,000 | $5,000 - $10,000 | ~33% - 50% |

Mid-Scale Dropshipping | $5,000 - $10,000 | $2,000 - $4,000 | ~20% - 40% |

Basic Home-Based Operation | $1,500 - $3,000 | $400 - $800 | ~13% - 27% |

If you are just starting, try to keep marketing spend around 3% to 8% of your expected revenue. Track your results and adjust your budget as you learn what works best.

Operational Expenses

Running a dropshipping business means you face many regular costs. These are your operational expenses. You need to know what these are so you can plan your budget and keep your business healthy. If you ignore these costs, you might find your profits shrinking fast.

Here are some of the most common operational expenses you will see in dropshipping:

E-commerce Platform Fees: You pay these to keep your online shop running. Platforms like Shopify or WooCommerce charge monthly fees. These can range from £20 to over £100, depending on your plan.

Payment Gateway Fees: Every time you make a sale, payment processors like PayPal or Stripe take a cut. This is usually about 2.9% plus 30p per transaction. If you sell to customers overseas, the fee can be even higher.

Marketing Budget: You need to spend money to attract customers. Many dropshippers set aside £250 to £400 each month for ads and promotions. This helps you test new ideas and scale up what works.

Tools and Apps: Running a shop is easier with the right tools. You might pay £8 to £25 a month for email marketing, £16 to £80 for inventory management, and extra for automation tools that save you time.

Shipping and Fulfilment Costs: Even though you do not hold stock, you still pay for shipping. Carriers like Royal Mail, DHL, or ePacket charge fees that change based on size, weight, and destination.

Business Registration and Licensing: Setting up your business comes with its own costs. You might pay £40 to £150 for registration and licences, depending on your location.

Taxes: You must pay VAT, sales tax, or income tax on your profits. The rates vary, so check what applies to your business.

Professional Services: Sometimes you need help from others. You might hire a freelancer for web design, copywriting, or even tax advice. These services can cost anywhere from £50 to several hundred pounds.

Tip: Keep a simple spreadsheet or use accounting software to track these expenses. This helps you spot where your money goes and find ways to save.

You might also want to invest in optional tools, like chatbots or virtual assistants. These can help you answer customer questions faster and keep your shop running smoothly. Some dropshippers use extra services for customer support or analytics. These tools can make your life easier, but always check if they fit your budget.

Operational expenses can add up quickly. If you plan for them and review your spending often, you will keep your business on track. You will also avoid nasty surprises at the end of the month. Remember, every pound you save on operations is a pound you can put back into growing your business.

Managing Finances in Dropshipping

Budgeting

You need a clear budget if you want your dropshipping business to survive and grow. Many new dropshippers make the mistake of spending too much too soon. Start with a small daily budget, maybe £5, to test the waters. This helps you learn about your market and see what works before you risk more money. Think of this first phase as a way to gather information, not just to make quick sales.

Once you have some data, set realistic expectations. Work out your average cost per click and conversion rate. This tells you how much you can spend and still make a profit. For example, you might set aside about £800 for your first month’s advertising. That’s around £27 per day. This amount lets you collect enough data without blowing your budget.

As you see which ads or products perform best, slowly increase your spending. Always check your return on investment. If an ad does not bring in sales, cut it and put your money into the ones that do. Treat your marketing spend as an investment in learning and attracting customers, not just a cost.

Tip: Review your budget every week. Adjust it based on what is working and what is not. This keeps you in control and helps you avoid nasty surprises.

Tracking Income and Expenses

Managing Finances means you must know where every pound goes. If you do not track your income and expenses, you will lose sight of your profits. You can use simple spreadsheets, but accounting software makes life much easier. Tools like QuickBooks Online or doola Bookkeeping let you connect your bank account, sort your expenses, and see your profits in real time.

Some dropshippers use apps like BeProfit or Expensify. These tools scan receipts, track ad spend, and show you detailed reports. If you sell on eBay, the AutoDS eBay Fees Calculator helps you work out your true profit after all the fees and shipping costs. These tools save you time and help you avoid mistakes.

Here are some steps to keep your records in order:

Record every sale and expense as soon as it happens.

Use software to automate as much as possible.

Check your profit and loss statement each month.

Review your cash flow to spot any problems early.

Keeping your financial records up to date helps you make better decisions. You will see where you can save money and where you should invest more.

Financial Goals

Setting clear financial goals gives you something to aim for. In your first year, do not expect huge profits. Most dropshipping businesses aim to break even and cover all their costs. If you finish the year with a small profit, you are on the right track. As your business grows, your profits should increase as well.

Here is a simple table to show what you might expect:

Year | Net Profit | Net Profit Margin | What to Aim For |

|---|---|---|---|

Year 1 | £20,000 | 10% | Cover all expenses and make a modest profit |

Year 2 | £80,000 | 20% | Grow profits with better systems and loyal customers |

Year 3 | £140,000 | 23% | Boost margins with repeat business and efficiency |

You should also plan how to use your money. Set aside funds for your website, marketing, supplier payments, and customer service. Keep some working capital for unexpected costs. This helps you stay flexible and ready for new opportunities.

Remember, Managing Finances is not just about tracking numbers. It is about setting goals, making smart choices, and building a business that lasts.

Cash Flow

Cash Flow Cycles

Cash flow is the heartbeat of your dropshipping business. You need to understand how money moves in and out. Dropshipping has a unique cycle that is much shorter than traditional retail. Here’s how it usually works:

Cash Outflow Phase: You pay your suppliers and cover marketing costs. You do not need to buy stock upfront, which saves you money.

Inventory Phase: You skip most inventory costs because you only buy products when customers order. Traditional shops pay for storage and handling, but you avoid these.

Sales Phase: You sell products online. Payments come through different channels, and you pay some fees.

Collection Phase: You wait for payment settlements. Some processors take longer to send you the money, which can slow things down.

Reinvestment Phase: You use your profits to pay for more ads or new products, starting the cycle again.

Dropshipping keeps your cash cycle short and less risky. You do not tie up money in stock or pay for a shop. Still, you face risks like returns, refunds, and shipping delays. These can affect your cash flow and customer happiness.

Note: Dropshipping businesses avoid big inventory costs, but you must watch for cash flow problems caused by slow payments or unexpected expenses.

Monitoring and Forecasting

You need to keep a close eye on your cash flow. If you do not, you might run out of money when you need it most. Start by checking your cash reserves and looking for any delayed payments. Watch for times when sales drop or expenses rise, like during slow seasons.

Here are some ways to monitor and forecast your cash flow:

Do a detailed cash flow analysis. Look at your income and spending to spot problems early.

Create forecasts for the next few weeks or months. List all the money you expect to come in and go out, including sales, loans, taxes, and bills.

Use automation software to track everything. Tools like Kolleno or Jirav help you see patterns and make better decisions.

Set clear goals for your cash flow. Plan your inventory and marketing based on sales trends and busy times of year.

Negotiate payment terms with your suppliers. Try to get more time to pay, which helps you keep cash in your business longer.

Build an emergency fund. Save a little each month to cover surprises.

Tip: Review your cash flow forecasts often. Update them if your sales or expenses change. This keeps your business ready for anything.

Improving Cash Flow

You can take simple steps to keep your cash flow healthy. Start by cutting any costs you do not need. Check your monthly bills and see where you can save. Negotiate with suppliers for better prices or longer payment terms. This gives you more time to pay and keeps more cash in your account.

Here are some practical steps you can try:

Send invoices quickly to get paid faster.

Offer flexible payment options to your customers.

Encourage early payments with small discounts.

Use inventory management software to avoid buying too much stock.

Review your prices and make sure you cover all your costs.

Build up an emergency cash reserve. Aim for enough to cover three to six months of expenses.

Use short-term financing only if you really need it, and do not rely on it too much.

A grocery store owner improved cash flow by asking suppliers for more time to pay, using software to track stock, and saving money in a high-interest account. You can do the same in your dropshipping business. Managing Finances well means you always know where your money is and how to make it work for you.

Remember: Good cash flow keeps your business running smoothly, even when things get tough.

Automation and Tools

Bookkeeping Software

You do not have to be an accountant to keep your dropshipping business tidy. Bookkeeping software makes things much simpler. It helps you track sales, spending, and profits without lots of paper. Many dropshippers like QuickBooks Online because it has strong tools for tracking stock and sales. Xero is another top pick. It is simple to use and suits small businesses well. If you want a free option, Wave gives you basic accounting tools. FreshBooks is good if you send many invoices or need to track your time. Zoho Books is a good choice for small and medium businesses, with lots of features.

BeProfit is very useful for dropshipping. It gives you detailed profit reports for your whole business. You can see which products earn the most and which ones do not do well. This helps you focus on what works and stop selling what does not.

Tip: Pick software that links with your e-commerce platform. This saves you time and keeps your records up to date.

Cloud-Based Solutions

Cloud-based accounting has changed how you run your business. You can check your money any time and from anywhere. This is great if you travel or work in different places. Cloud tools are cheap and work well, especially for new businesses. You do not have to worry about losing your data because it stays safe online.

Here are some reasons to use cloud-based tools:

You can see your financial data all day, every day.

The software grows with your business as you get more sales and users.

Automation cuts down on mistakes and saves you lots of time.

Real-time reports help you make quick choices.

Many tools link straight to Shopify, WooCommerce, or other platforms, so your sales and spending update by themselves.

Traditional accounting can give you personal advice, but it is not as fast or flexible as cloud tools. Some dropshippers use both to get the best results.

Automating Tasks

Automation saves you time and keeps your records right. You can let software do many jobs that used to take hours. Here is a table showing what you can automate and how it helps:

Financial Task | What It Does | Why It Helps | Example/Impact |

|---|---|---|---|

Order Syncing | Pulls order details from your shop into your accounts | Saves time, reduces errors | Tools like A2X or Synder sync orders from Shopify or Amazon |

Cost of Goods Sold (COGS) | Links each sale to its true cost | Shows real profit, helps with pricing | See your gross profit per sale, even with 1,000 orders a month |

Invoice Generation | Creates and sends invoices automatically | Speeds up payments, reduces mistakes | Sends invoices with payment links, improving your cash flow |

Bank Reconciliation | Matches bank transactions to your records | Keeps your books accurate, flags problems | Stripe payouts matched to Shopify orders without manual work |

Profit Tracking & Margin Analysis | Gives live dashboards for sales, expenses, and profits | Helps you spot best-sellers and weak spots | See top products and profit leaks in real time |

Sales Tax Calculations | Applies correct tax rates and files returns | Keeps you compliant, avoids fines | Tools like TaxJar handle tax for every sale, even across borders |

You can automate almost every part of your bookkeeping. This means you spend less time on paperwork and more time growing your business. Managing Finances gets much easier when you let technology do the hard work.

Note: Start with one small task. Automate it first. Soon, you will wonder how you ever worked without these tools.

Accounting and Reporting

Basic Principles

You need to understand some basic accounting principles to keep your dropshipping business healthy. Accurate records help you track your sales, expenses, and profits. This gives you a clear view of your cash flow and helps you set the right prices. If you keep good records, you can spot problems early and make better decisions.

You must also follow tax laws in every region where you sell. This keeps you safe from audits and fines. You can choose to do your own accounts, hire a professional, or use accounting software. The best choice depends on how big and complex your business is. Many dropshippers use software that links with their shop and automates bookkeeping. This saves time and reduces mistakes.

Here are some key steps you should follow:

Stick to the main accounting rules, like honesty, consistency, and care.

Record every transaction, post it to your ledger, and check your balances often.

Decide if you want to use cash or accrual accounting. Pick the one that fits your business best.

Use software to make the process easier and more accurate.

Report your finances on time so you always know where you stand.

Keeping your accounts up to date helps you avoid surprises and keeps your business running smoothly.

Revenue Recognition

Revenue recognition can feel tricky in dropshipping. You need to know when to count a sale as income. The best practice is to recognise revenue when the product ships to your customer. This shows you have earned the money, even if you have not received payment yet.

Always track what you owe to suppliers and what customers owe you. This keeps your finances healthy.

Value your inventory, even if you never see it. This helps you work out your true costs.

Use reports to check your sales, expenses, and profits. This helps you make smart choices.

Match your sales with the costs in the same period. This gives you a clear picture of your profits.

If you use accrual accounting, you record income when you earn it, not when you get paid. For example, if you sell a product today but the customer pays next week, you still count the sale today. This method gives you a better view of your business health.

Tip: If you act as a principal, you record the full sale amount. If you act as an agent, you only record your share. Always check your role in each transaction.

Financial Reports

Financial reports help you see how your business is doing. You should keep records of every sale, expense, and profit. This helps you follow tax rules and spot trends.

Here are the main reports you need:

Profit and Loss Statement: Shows your income and expenses. Helps you see if you make money or lose it.

Balance Sheet: Lists what you own and what you owe. Gives you a snapshot of your business health.

Cash Flow Statement: Tracks money coming in and going out. Shows if you have enough cash to pay your bills.

Report Type | What It Shows | Why It Matters |

|---|---|---|

Profit and Loss | Income, expenses, and net profit | Checks if you are profitable |

Balance Sheet | Assets, liabilities, and equity | Shows your financial position |

Cash Flow Statement | Cash in and out over time | Helps manage your cash reserves |

You should review these reports often. They help you spot problems, plan for growth, and make better decisions. Good reporting keeps your dropshipping business strong and ready for anything.

Tax and Compliance

Tax Obligations

You might feel a bit lost when it comes to taxes in dropshipping. You are not alone! Taxes can get tricky, especially if you sell to customers in different places. In the United States, you have a few main tax duties to keep in mind:

You must pay federal income tax on your profits. Most dropshippers pay this every quarter.

State income tax might also apply, depending on where you run your business.

You need to collect sales tax from customers in states where you have a “nexus”. Nexus means you have a strong connection to that state, like lots of sales or a warehouse.

You must register for a seller’s permit in most states before collecting sales tax.

Some states want you to pay source tax to suppliers, based on the product or where the supplier is.

If you import goods, you may need to pay customs and duty taxes.

You should get a tax ID to prove you can collect sales tax.

Sales tax rules change from state to state. Some states do not even require a seller’s permit. You need to set up your online shop to collect the right sales tax based on where your customer lives. If you miss this step, you could face fines or extra bills later.

Tip: You can lower your tax bill by claiming deductions for things like advertising, travel, and even your home office. Always keep proof of these expenses.

Organised Records

Keeping your records tidy makes tax time much easier. You should always know where your money comes from and where it goes. Here are some best practices:

Keep accurate records of every sale, expense, and refund.

Use accounting software to track your income and spending. This saves time and reduces mistakes.

Choose an accounting method—cash basis or accrual—and stick with it.

Prepare key financial statements, like income statements, cash flow statements, and balance sheets.

Set up a budget and forecast your future spending. This helps you avoid surprises.

Reconcile your books with your bank statements. This catches errors and helps prevent fraud.

Write down your recordkeeping rules and follow them every month.

If you use software, you can automate many of these steps. This means fewer errors and more time for you to grow your business.

Keeping your records organised is not just about taxes. It helps you spot problems early and keeps your business running smoothly.

Professional Help

Sometimes, you need an expert. Tax laws change often, and dropshipping can get complicated fast—especially if you sell in many states or countries. A tax professional can help you:

Understand which taxes you must pay and when.

Find deductions you might miss, like shipping or advertising costs.

Make sure you follow all the rules and avoid penalties.

Stay up to date with new tax laws.

If you ever feel unsure about your tax duties or how to file, reach out to a professional. They can save you money and stress. You will also feel more confident knowing your business is on the right track.

Note: Getting advice early can help you avoid costly mistakes and keep your dropshipping business healthy for years to come.

Financial Health and Resilience

Assessing Health

You need to check your business health often. This helps you spot problems before they grow. Start by looking at a few key numbers. These numbers tell you if your dropshipping business is strong or needs help.

Gross Profit Margin: This shows how much money you keep after paying for products. Aim for a margin between 20% and 50%. If your margin drops, you might need to raise prices or cut costs.

Order Fulfilment Rate: This is the percentage of orders you ship on time. Try to keep this above 95%. High rates mean happy customers and smooth operations.

Customer Acquisition Cost (CAC): This tells you how much you spend to get a new customer. If this number is too high, your ads might not work well.

Average Order Value (AOV): This is the average amount each customer spends. Higher AOV means you sell more per order.

Return Rate: This is the percentage of orders customers send back. Keep this below 5%. High returns can mean poor product quality or unclear descriptions.

You should also check your profit margins and how well you use your assets. Look at your Net Profit Margin to see if you make money after all costs. Check your Return on Assets to see if your business uses its resources well. Keep an eye on your Debt to Equity Ratio. If it stays below one, you do not rely too much on loans.

Tip: Track these numbers every month. Use a simple spreadsheet or accounting software. This helps you see trends and make better choices.

Working Capital

Working capital is the money you use to run your business day to day. You need enough to pay suppliers, cover ads, and handle returns. If you run out, you might miss out on sales or upset customers.

To keep your working capital healthy, follow these steps:

List all your regular costs, like product payments, shipping, and marketing.

Set aside extra money for slow sales months or sudden expenses.

Review your cash flow often. Make sure you have enough to cover at least one month of costs.

Avoid tying up money in slow-moving products. Focus on best-sellers.

A good rule is to keep a cash buffer. This means you always have money ready for emergencies. If you plan well, you will not panic when things get tough.

Paying Yourself

You work hard, so you should pay yourself. Many dropshippers forget this step. If you do not pay yourself, you might lose motivation or mix up your business and personal money.

Set a regular amount to take out each month. Treat it like a salary. This helps you plan your spending and keeps your business money separate. Start small if your profits are low. As your business grows, you can increase your pay.

Remember: Paying yourself is not selfish. It shows you value your work and helps you build a business that lasts.

Financing Options

You might reach a point where your dropshipping business needs extra money. Maybe you want to launch a new product, run bigger ads, or cover a slow sales month. You have several ways to get funding. Each option has its own pros and cons. Let’s look at the most common choices.

1. Self-Funding

You can use your own savings to grow your business. This is the safest way because you do not owe anyone money. You keep full control. Many dropshippers start this way. If you use your own cash, set a limit. Only invest what you can afford to lose.

2. Business Credit Cards

A business credit card gives you quick access to funds. You can pay for ads, tools, or stock. Some cards offer rewards or cashback. You must pay off the balance each month to avoid high interest. If you miss payments, debt can grow fast.

Tip: Use a business credit card only for business expenses. This keeps your records clean and helps you track spending.

3. Bank Loans

Banks offer loans to small businesses. You get a lump sum and pay it back over time. Loans work well if you have a clear plan and steady sales. Banks may ask for a business plan or proof of income. Interest rates can vary. Always check the terms before you sign.

4. Online Lenders

Online lenders like Funding Circle or Kabbage offer fast loans. You can apply online and get a decision quickly. These loans often cost more than bank loans. They suit dropshippers who need money fast or do not qualify for a bank loan.

5. E-commerce Financing

Some platforms, like Shopify Capital or PayPal Working Capital, offer funding based on your sales. They look at your shop’s performance, not your credit score. Repayments come from your daily sales. This means you pay more when you sell more and less when sales slow down.

Financing Option | Speed | Risk Level | Best For |

|---|---|---|---|

Self-Funding | Instant | Low | New or small businesses |

Business Credit Card | Fast | Medium | Short-term needs |

Bank Loan | Slow | Medium | Growth with steady sales |

Online Lender | Very Fast | High | Quick cash, less paperwork |

E-commerce Financing | Fast | Medium | Shops with regular sales |

6. Friends and Family

You can ask friends or family for a loan or investment. This can be quick and flexible. Make sure you agree on repayment terms. Write everything down to avoid misunderstandings.

Note: Only borrow what you can repay. Money issues can hurt relationships.

7. Crowdfunding

Crowdfunding lets you raise money from many people online. You offer rewards or early access to your products. Platforms like Kickstarter or Indiegogo help you reach a wide audience. Crowdfunding works best for unique or exciting products.

You have many ways to fund your dropshipping business. Choose the option that fits your needs and risk level. Always read the terms and plan how you will repay any money you borrow. Smart financing helps your business grow without stress.

Growth and Adaptability

Diversifying Products

You want your dropshipping business to grow. One of the best ways is to offer more products. If you only sell one type of item, you risk losing sales when trends change. Try adding new products that fit your shop’s theme. For example, if you sell fitness gear, you could add water bottles, yoga mats, or gym bags.

Here’s how you can start diversifying:

Listen to your customers. Check reviews and messages. People often ask for things you do not sell yet.

Watch your competitors. See what they add to their shops. This gives you ideas for your own store.

Test new products in small batches. Do not buy too much at first. See what sells before you invest more.

Use supplier directories. Platforms like AliExpress or SaleHoo show trending items.

Tip: Keep your brand in mind. Only add products that make sense for your audience. This keeps your shop looking professional.

Ongoing Learning

Dropshipping changes fast. You need to keep learning if you want to stay ahead. New tools, marketing tricks, and rules come out all the time. Make learning a habit.

Here are some easy ways to keep learning:

Read blogs and guides. Sites like Oberlo, Shopify, and SaleHoo share tips every week.

Join online groups. Facebook groups and Reddit forums have thousands of dropshippers. You can ask questions and share advice.

Watch YouTube tutorials. Many experts post step-by-step videos.

Take short courses. Websites like Udemy or Coursera offer affordable classes.

Learning Resource | What You Get | Cost |

|---|---|---|

Blogs | Free tips and news | Free |

YouTube | Video guides | Free |

Online Courses | In-depth lessons | £10–£50 |

Forums/Groups | Community support | Free |

Note: Set aside 30 minutes each week for learning. Small steps help you stay sharp.

Adapting Strategies

You cannot use the same plan forever. Markets shift. Customer tastes change. You need to adapt your strategies to keep your business strong. Start by checking your sales data. Look for products that slow down or ads that stop working.

Try these steps to adapt quickly:

Review your numbers. Check your profit, costs, and best-sellers every month.

Test new marketing channels. If Facebook ads slow down, try Instagram or TikTok.

Change your offers. Run a sale or bundle products to boost interest.

Ask for feedback. Your customers can tell you what they want next.

If you stay flexible, you can handle any challenge. Your dropshipping business will keep growing, even when things change.

You have learned how to keep your dropshipping business on track. Separate your business and personal money. Use automation tools to save time and avoid mistakes. Check your numbers often and change your plan when you need to. Try one new financial habit this week. Small steps can make a big difference. Ready to take control? Your business will thank you!

FAQ

How much money do I need to start a dropshipping business?

You can start with as little as £200–£500. This covers your website, marketing, and first orders. Start small and grow as you learn what works best for your shop.

Do I need an accountant for my dropshipping business?

You do not need one at the start. Good accounting software can help you track everything. If your business grows or taxes get tricky, an accountant can save you time and stress.

What is the best way to track my expenses?

Use accounting software like QuickBooks or Xero. These tools connect to your bank and show your spending in real time. You can also use a simple spreadsheet if you prefer.

How do I handle refunds and returns?

Always set aside money for refunds. Create a clear returns policy on your website. Respond to customers quickly and work with your suppliers to solve problems fast.

Tip: Good customer service builds trust and keeps people coming back.

Can I use my personal bank account for business?

You should not. Open a separate business account. This keeps your records clear and protects your personal money if something goes wrong.

What should I do if my cash flow is tight?

Check your spending and cut costs where you can. Ask suppliers for better payment terms. Try to boost sales with special offers or bundles.

Action | Result |

|---|---|

Cut expenses | More cash available |

Negotiate terms | Pay suppliers later |

Run promotions | Increase quick sales |

How often should I review my finances?

Check your numbers every week. This helps you spot problems early and make better decisions. Monthly reviews give you a bigger picture of your business health.

TangBuy: A Smarter Way to Dropship in 2025

If you're looking to stay competitive with dropshipping in 2025, speed and trend-awareness are key. TangBuy helps you stay ahead with real-time product trends, fast fulfilment, and factory-direct sourcing. With over 1 million ready-to-ship items, 24-hour order processing, and seamless Shopify integration, TangBuy makes it easier to test, scale, and succeed in today's fast-moving eCommerce landscape.

See Also

Essential Strategies For eBay Dropshipping Success In 2025

Complete Stepwise Plan To Start Dropshipping Business 2025

Easy Methods To Earn Income Dropshipping On eBay 2025