High Profit Potential Awaits Sellers in the Online Smartwatch Market

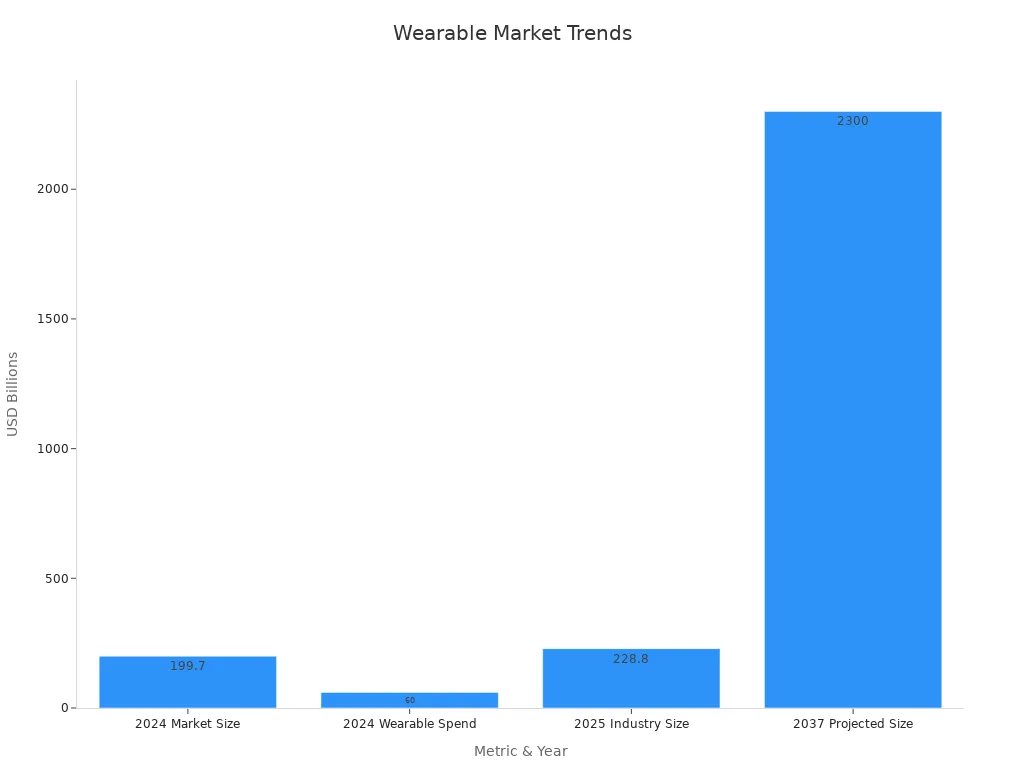

The online smartwatch market offers sellers a high profit potential. This is because many people want smartwatches, and the number of users is rapidly increasing. The global smartwatch market is projected to grow from $50.57 billion in 2025 to $143.19 billion by 2032, representing a 15.6% annual growth rate. The number of smartwatch users worldwide is expected to rise quickly, reaching over 740 million by 2029.

Year | Estimated Smartwatch Penetration Rate |

|---|---|

2019 | 2.01% |

2020 | 2.5% |

2021 | 2.69% |

2022 | 2.78% |

2023 | 2.86% |

2024 | 2.89% |

2025* | 2.9% |

2026* | 2.9% |

2027* | 2.89% |

2028* | 2.88% |

Wearable technology remains highly popular among buyers, with most purchases made online. Online sales account for 60% of all transactions. Sellers entering this fast-growing market can capitalize on the high profit potential created by increasing demand and rapid market expansion.

Key Takeaways

The online smartwatch market is growing very fast. Sales may reach over $140 billion by 2032. This gives sellers many chances to make money.

Most sellers make high profits between 45% and 55%. This is because many people want smartwatches. Supply chains also work well.

Buyers want smartwatches with long battery life. They also want health tracking and easy phone connection. Giving customers these features helps sellers sell more.

Big brands like Apple and Samsung are the top sellers. But smaller and cheaper watches are also selling more now. This gives sellers many ways to sell smartwatches.

Sellers do well when they find good products. They also need to make clear listings. Using smart marketing helps too. Good customer service is also important.

Smartwatch Types

Mainstream vs. Niche

Smartwatches are split into two big groups: mainstream and niche. Mainstream smartwatches, like Apple and Samsung, are the most popular. These brands make watches that many people like. They help with daily tasks, track health, and work well with smartphones. Niche smartwatches, such as Garmin or hybrid models, are for special groups. Athletes, outdoor fans, or people who want a classic look with smart features choose these.

The table below shows how online sales, operating systems, and market share are different:

Dimension | Data (2023) | Projection (2024) |

|---|---|---|

Online Sales Share | 60% of total smartwatch sales | |

Average Selling Price (ASP) | USD 259 | USD 265 |

Market Share by OS | watchOS: 32%, Wear OS: 25%, Proprietary OS: 43% | watchOS: 31%, Wear OS: 27%, Proprietary OS: 42% |

Niche Market Share | 12% (diving, hiking, extreme sports) | 14% |

Mainstream smartwatches keep growing and are led by big brands. The market is steady, and most people buy new ones to replace old ones. Niche smartwatches, like smart rings and sports watches, are growing faster but are still not as common.

Apple and Samsung are the top brands in the smartwatch market.

Niche products like smart rings are growing quickly but are still small.

Most people want health and wellness features.

Features and Audiences

Smartwatches have many features for different people. Mainstream watches do many things, like show notifications, make calls, let you pay, and track health. Niche smartwatches are tough, last longer on one charge, and have special sports tools like GPS and VO2 max.

Category | Market Share (%) | Target Consumer Segment | Key Features & Usage Behavior |

|---|---|---|---|

Mainstream (Apple) | Broad adult users, health-conscious, iPhone users | Seamless iPhone integration, advanced health tracking, daily convenience | |

Mainstream (Samsung) | 10-15 | Android users, broad demographic | Health tracking, Android compatibility, affordability |

Niche (Garmin) | 5-8 | Athletes, outdoor enthusiasts | Durability, GPS, performance analytics, built-in maps |

Hybrid Smartwatches | N/A | Style-focused consumers | Analog aesthetics, basic smart functions |

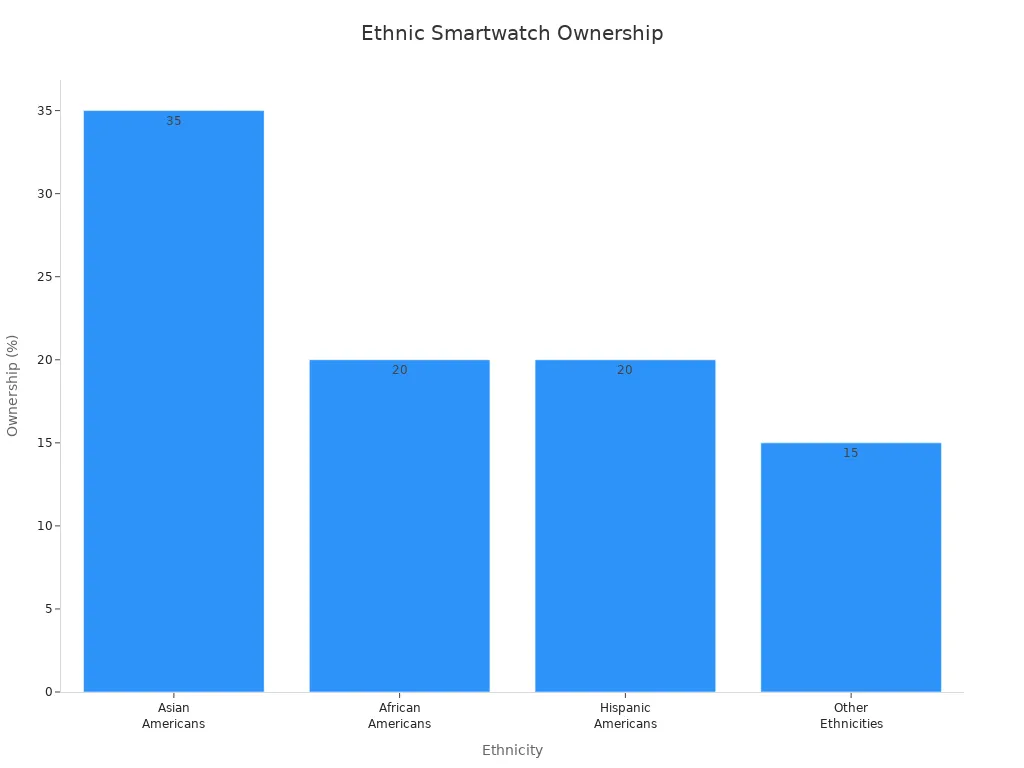

Age and gender affect what people want in a smartwatch. Young people ages 18-24 like fitness and health features. Adults ages 35-54 want to talk and get work done. Older adults (55+) like bigger screens and health checks. More women ages 18-34 own smartwatches than men their age. Asian Americans have the highest ownership at about 35%.

Tip: Sellers who match the right features to the right people can sell more and make customers happier.

High Profit Potential

Profit Margins

Online smartwatch sellers make some of the biggest profits in electronics. Most sellers get profits between 45% and 55%. This happens because many people want smartwatches. Sellers also have good supply chains and can grow their business easily. If sellers buy a lot at once, they save money and make more profit on each watch.

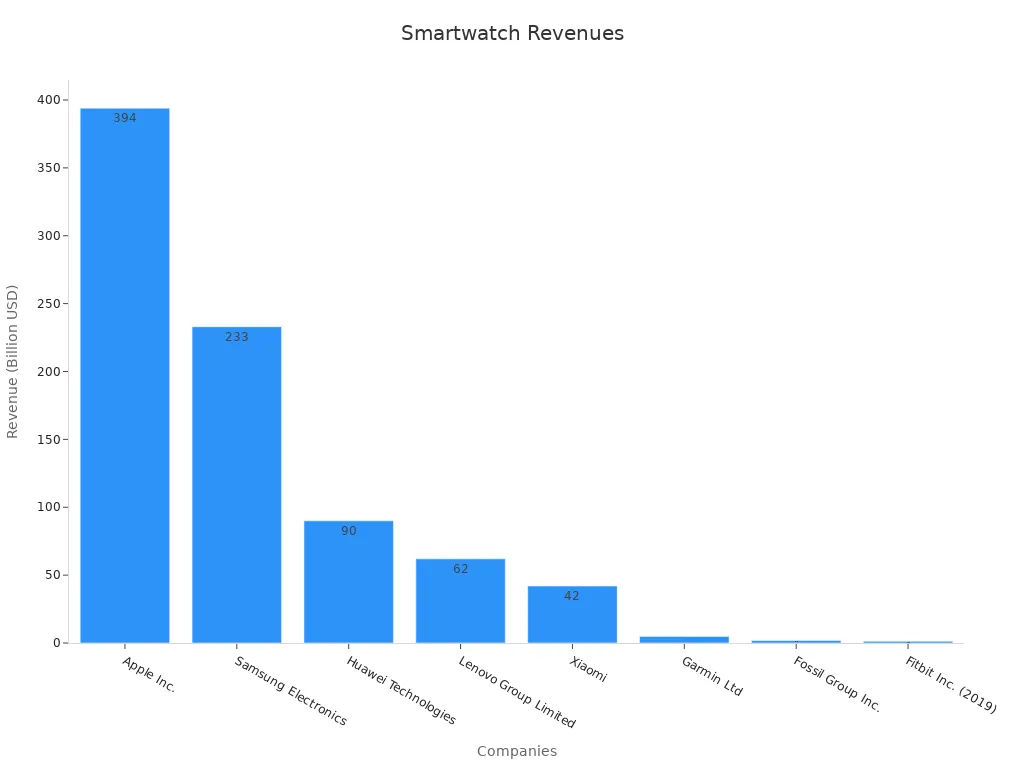

Big smartwatch companies show how strong this market is. The table below lists how much money top brands made in 2023:

Company | Revenue (2023) |

|---|---|

Apple Inc. | |

Samsung Electronics | $233 billion |

Huawei Technologies | $90 billion |

Lenovo Group Limited | $62 billion |

Xiaomi | $42 billion |

Garmin Ltd | $4.86 billion |

Fossil Group Inc. | $1.8 billion |

Fitbit Inc. (2019) | $1.21 billion |

These numbers show that smartwatches bring in a lot of money. Both big brands and new sellers want to join this market. Online stores help sellers reach people all over the world. This means they can sell more and make bigger profits.

Sell Rates

Smartwatches sell fast on the internet. The average sell rate is over 63%. On sites like Poshmark, sellers can sell more than 20 smartwatches each day. It usually takes about 52 days to sell a smartwatch. This is much faster than selling other electronics.

Many things help smartwatches sell quickly:

Shopping online is easy and lets people compare prices.

Reviews and ratings help buyers choose fast.

Discounts and deals bring in more shoppers.

People can buy from many places, like brand sites, Amazon, or eBay.

EveryWatch is a platform that checks sales from over 400 places. It uses artificial intelligence and people to make sure the numbers are right. EveryWatch tracks daily sales and how often watches are sold. This helps sellers see trends and change their plans if needed.

Note: Fast sell rates help sellers move products quickly. This lowers storage costs and gives them more money to use.

The smartwatch market is growing very fast. In 2024, the market was worth $53.2 billion. By 2033, experts think it will reach $218.89 billion. The yearly growth rate is 17%. Another guess says the market could be $233.25 billion by 2032, with a 25.04% growth rate each year. These numbers show that sellers can make a lot of money if they join or grow in this market.

Market Growth Metric | Value |

|---|---|

Market Size in 2024 | |

Forecast Market Size in 2033 | USD 218.89 Billion |

Compound Annual Growth Rate | 17.0% (2025-2033) |

Market Value Projection (2032) | USD 233,250.14 million |

CAGR (forecast period) | 25.04% |

Sellers who know these facts can do well. High profits, quick sales, and a growing market make this a great chance. The profit potential for online smartwatch sellers is better than most other products.

Market Demand

Growth Trends

The smartwatch market is getting bigger every year. In 2022, it was worth $37.97 billion. By 2030, it could reach $71.57 billion. This means the market grows about 8.2% each year. In 2023, the market was $34.1 billion. By 2032, it may go up to $75.29 billion. North America has more than 44% of the market. This is because people there use new technology and care about health.

Many things help the market grow:

Health and fitness tracking brings in new buyers.

Young people and tech fans buy smartwatches fast.

Cheaper models let more people buy them.

Brands add new things like AI coaching and stress checks.

In 2024, the market dropped by 4.5%. This happened because of cheaper brands and too many choices in some places. Experts think the market will get better in 2025. Shipments should go up by 0.9%. From 2025 to 2029, the market will keep growing. This shows the market is getting stronger and more stable.

Metric | Value | Notes |

|---|---|---|

Market size (2022) | $37.97 billion | Large and growing market |

Projected market size (2030) | $71.57 billion | Sustained growth |

CAGR (2022-2030) | 8.2% | Steady expansion |

North America market share (2021) | 44.2% | Regional dominance |

Price segment growth | 9.8% CAGR ($0-99) | Affordable options expand consumer base |

Smartwatches now have features for kids and older people. Brands want everyone to use smartwatches, no matter their age.

Consumer Preferences

People want smartwatches that match their daily life. A survey says 65% of people want long battery life most. Fitness and health tracking is next, with 44% saying it is very important. Display quality matters to 39% of buyers. This is extra true in India and Mexico. Many people also like phone alerts, music, and cool looks.

Health services with subscriptions are getting more common.

Apple is the top brand with great health sensors and easy use.

Garmin is popular with athletes for GPS and strong design.

People pick brands for battery life, accuracy, how they work with phones, and style.

Different places like different things. French buyers want to make calls. Indian buyers care about the screen. Cheaper smartwatches help more people try them. This makes the market even bigger.

Brands that know what people want, like long battery life and health tools, can do well in the online smartwatch market.

Competition

Major Brands

The smartwatch market has many companies fighting for the top spot. Apple is the leader with 22% of the market in 2024. Apple is very popular in North America. Samsung has 9% of the market. Huawei has 13% and does well with mid-range smartwatches. Xiaomi and Amazfit are growing fast by selling cheaper models. Xiaomi now has 8% of the market. Imoo has 6%, showing that Chinese brands are getting stronger in Asia-Pacific.

Brand | Market Share (2024) | Segment | Regional Strength |

|---|---|---|---|

Apple | 22% | High-end | North America |

Huawei | 13% | Mid-range | Asia-Pacific, China |

Samsung | 9% | High-end | Global |

Xiaomi | 8% | Budget-friendly | Asia-Pacific, China |

Imoo | 6% | Kids/Budget | China |

Big brands try to win by making new features and strong ads. Apple, Samsung, Garmin, and Fitbit spend money on health tools and new technology. Niche brands make watches for athletes and people who love the outdoors. Both old and new brands keep making new models to get more buyers.

Note: In 2024, China shipped the most smartwatches. This happened because Huawei and Xiaomi did very well.

Market Risks

Both new and old brands face many problems in the smartwatch market. Tariffs have made parts cost up to 25% more. This makes it more expensive to make smartwatches and lowers profits. Problems with the supply chain cause delays and higher costs. Rules and trade laws make it hard for companies to sell in new places.

Risk Factor | Description |

|---|---|

Increased Production Costs | Tariffs have raised component prices by up to 25%, increasing costs and reducing margins. |

Supply Chain Disruptions | Global supply chain issues cause delays and higher operational costs. |

Regulatory Hurdles | Tariffs and trade policies create higher market entry barriers for new entrants. |

Operational Challenges | Higher costs and delays reduce operational efficiency and profitability. |

Strategic Reassessment | Companies must adjust sourcing and manufacturing strategies to navigate trade uncertainties. |

Other problems include:

Battery life is short, so watches need charging often.

People worry about data privacy, so they may not buy.

Cheaper brands make it hard to sell expensive watches.

High prices stop some people from buying, especially in new markets.

Companies need to keep making new things, plan well, and follow rules to stay ahead and handle these risks.

Selling Tips

Sourcing

Sellers need to get good smartwatches to do well. Top brands like Apple, Samsung, Garmin, Fitbit, and Fossil are important for any store. Many sellers use online wholesale sites like Eze Wholesale to find trusted products. They also work closely with suppliers and check if items are real to keep quality high.

Sellers look at the market to see what is popular.

Watching new tech and styles helps sellers pick the best watches.

Getting watches from top and mid-level brands in the $101–$500 range fits what most buyers want.

Ordering often and paying on time helps sellers build trust with suppliers.

Tip: Good ways to get products mean sellers always have quality items. This makes customers happy and trust the store.

Listings

Good product listings help sellers get more sales and be seen. Sellers should use titles with important words, clear pictures, and full details.

Make listings easy to read and give facts about features and what phones work.

Ask buyers to leave good reviews and reply fast to their messages.

Change prices to stay ahead and try to win the Buy Box on big websites.

Try different listing ideas and make sure they look good on phones.

A strong listing brings in buyers and makes them trust the seller. This leads to more sales and better profits.

Marketing

Online marketing helps sellers reach people who want smartwatches. The best sellers use social media, work with influencers, and run ads online.

Sellers check how many people buy, like posts, and open emails to see what works.

They use tools to group buyers, like people who love fitness or work in offices.

Sellers start hashtag challenges and ask buyers to share their own photos.

Giving choices, like custom watch faces, makes buyers want to come back.

Note: Brands that show ads to the right people get more new and repeat buyers. They also sell more smartwatches.

Customer Service

Great customer service makes buyers want to shop again. Sellers should ship fast, talk clearly, and make returns simple.

Sellers check scores like CSAT and NPS to see if buyers are happy.

They use tools to find out how buyers feel and make service better.

Fixing problems fast keeps buyers from leaving and helps them stay.

A good service record helps sellers stand out and do well for a long time in the smartwatch market.

The smartwatch market is growing fast and making lots of money. People really want smartwatches, so sales keep going up. In 2022, the market was worth $23.5 billion. By 2032, it could reach $121.5 billion. The market grows about 17.8% each year.

Metric | Value/Range |

|---|---|

Sell Rate | ≥ 63% |

Average Selling Price | $216 - $306 |

Keyword Search Volume | 1,900 - 110,000 |

Sellers who know about products and trends can do well. They should also learn about their competition to get ahead. Industry reports give more details about the market and companies. These reports show new ideas and how brands are different. Learning what buyers want and using good marketing helps sellers win in the online smartwatch market.

FAQ

What profit margins can online smartwatch sellers expect?

Most online smartwatch sellers make profits between 45% and 55%. High demand helps sellers keep these good profits. Good supply chains also help. Buying in bulk can make profits even higher.

Which platforms work best for selling smartwatches online?

Amazon, eBay, and Poshmark are popular places to sell. Many sellers also use their own websites. Each platform has different buyers and tools to help sellers.

How can sellers stand out in a crowded smartwatch market?

Sellers should offer quality products and clear listings. Good customer service is important. Special features or bundles can bring in buyers. Fast shipping and good reviews help build trust.

What features do buyers look for most in smartwatches?

Buyers want long battery life and health tracking. Easy smartphone connection is important too. Many people like stylish designs and water resistance. Fitness features are always popular.

Are there risks in selling smartwatches online?

Yes, there are risks for sellers. Delays in supply chains can happen. Production costs can go up. Rules and laws may change. Cheaper brands can make it hard to earn money. Sellers who stay informed can lower these risks.

TangBuy: A Smarter Way to Dropship in 2025

If you're looking to stay competitive with dropshipping in 2025, speed and trend-awareness are key. TangBuy helps you stay ahead with real-time product trends, fast fulfilment, and factory-direct sourcing. With over 1 million ready-to-ship items, 24-hour order processing, and seamless Shopify integration, TangBuy makes it easier to test, scale, and succeed in today's fast-moving eCommerce landscape.

See Also

Top Dropshipping Niches To Profit From In 2025

Affordable Products That Deliver High Profits In 2025

Hot Selling Products To Maximize Earnings In 2025