Understanding the New Tariffs and What They Mean for Dropshippers

E-commerce dropshippers now deal with new tariffs. These tariffs can be as high as 145%. This sudden rise in tariffs affects almost every dropshipping business that imports goods. It is especially hard for those importing from China and Hong Kong. Many e-commerce dropshippers feel worried about higher costs. They also worry about making less money. The table below shows how big these changes are:

Aspect | Details |

|---|---|

Percentage of Dropshipping Businesses Affected | Almost all international e-commerce dropshippers are affected |

Tariff Increase | Tariffs on Chinese imports can go up to 145% |

Removal of Exemption | The $800 de minimis exemption is gone, so all shipments are taxed |

Market Impact | Many e-commerce dropshippers are closing or stopping their stores |

E-commerce dropshippers now see higher manufacturing costs and shipping fees. Some dropshipping business models do not make money anymore. Shoppers may see higher prices or fewer products to choose from. Dropshipping owners must change how they work. They need to look at new suppliers, use automation tools, and think about buying from local sources. The new tariffs mean dropshippers must act fast and be ready to change.

Key Takeaways

New tariffs make most dropshipping imports cost more, especially from Mexico, and Canada. Dropshippers now pay higher prices for products and shipping. Customs checks can also slow down deliveries and lower profits. Many dropshippers choose local or different suppliers to skip tariffs and get faster shipping. Selling products with bigger profit margins helps businesses stay strong. Using tools to track profits is also helpful. Automation and tariff calculators help avoid mistakes and save time. They also help dropshippers follow new trade rules. Telling customers about price changes clearly builds trust and keeps them loyal. Following customs and VAT rules closely stops fines, delays, and lost items. Changing quickly by using new suppliers, technology, and pricing helps dropshippers succeed for a long time.

New Tariffs Overview

What Are Tariffs?

Definition

Tariffs are taxes on goods brought into a country. They make imported items cost more than local ones. Countries use tariffs to help their own businesses and workers. The World Trade Organization (WTO) makes rules for tariffs. These rules keep trade fair and steady. Most countries must treat each other the same with tariffs. Sometimes, special trade deals allow exceptions.

Calculation

Governments have different ways to set tariffs.

Ad valorem tariffs are a percent of the product’s price. For example, a 5% tariff on a £20,000 car adds £1,000 in tax.

Specific tariffs are a fixed fee for each item, like £10 for every bicycle.

Compound tariffs use both ways, such as £0.50 per kilogram plus 3% of the value.

Tariff-rate quotas let some imports in at a low tariff, but charge more if the limit is passed.

Trump’s New Tariffs

Key Changes

Trump’s new tariffs are a big change from before. They add a 25% tariff on imports from Canada and Mexico. Canadian energy has a 10% tariff. Imports from China now have a 10% tariff. These changes raise the average US tariff from 2.4% to 10.5%. The new tariffs end duty-free status for many goods. This makes it harder for dropshippers to keep costs down. Modern supply chains feel these changes more than ever. The higher tariffs also bring new rules and possible extra tariffs from other countries.

Timeline

The timeline for these tariffs matters for dropshipping businesses.

Date | Event Description | Impact on Dropshipping Businesses |

|---|---|---|

A 10% global tariff starts on all imports | Ends duty-free on low-value imports; raises costs and rules. | |

De Minimis exemption ends for Chinese imports (under $800 not duty-free) | All Chinese imports now have duties and need customs; costs go up and logistics get harder. | |

June 1, 2025 | Postal shipments from China face flat duties (£50 or 30% of value, whichever is more) | Postal shipments cost more; dropshippers may stop using untracked shipping. |

Late 2025 | Global phase-out of De Minimis exemption for all countries (date not set) | Dropshipping businesses must get ready for more tariffs and harder rules. |

Affected Products and Countries

High-Risk Goods

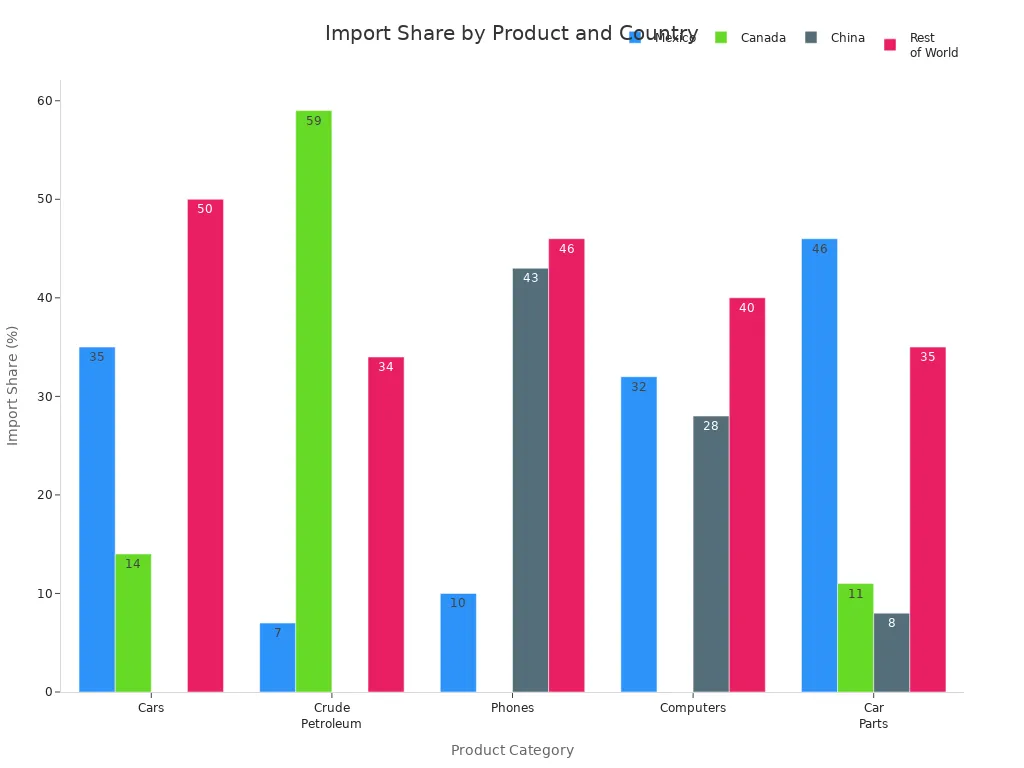

The new tariffs hit some products the hardest. Cars, crude petroleum, phones, computers, and car parts are most at risk. Dropshippers selling electronics or car accessories will see the biggest changes. The chart below shows which countries send the most of these goods:

Major Exporters

Mexico, Canada, and China are the main countries affected by the new tariffs. Mexico sends the most cars and car parts. Canada sends the most crude petroleum. China is the top source for phones and computers. In 2024, the US trade deficit with these three countries was about $529 billion. Imports from them made up 86% of all goods hit by the new tariffs. Policymakers say they want to fix unfair trade and protect supply chains. They also want to lower the trade deficit and make competition fairer.

Note: Policymakers often say unfair trade, like subsidies and intellectual property theft, is why tariffs on imports from China are rising. They also want to protect national security and jobs in America.

Tariffs Impact on Dropshipping

Increased Costs

Product Prices

E-commerce dropshippers now pay much more for products. Tariffs are like extra taxes on imports. Suppliers, especially in China, have raised their prices. For example, a 25% tariff on a $100 item makes it cost $125 before shipping. The average U.S. tariff has jumped from 2.5% to 18.8%. This is the highest since 1933. Many small items used to make money. Now, they struggle because the de minimis exemption is gone. Even shipments under $800 get taxed. This is tough for dropshippers. Most orders are small and happen often.

Tariffs now add 10% on most imports, 25% on some, and up to 145% on some Chinese goods.

Suppliers pass these costs down, so dropshippers must raise prices or earn less.

Higher product costs mean less profit and force many to change what they sell.

Shipping Expenses

Shipping costs have also gone up. Tariffs make the whole supply chain more expensive. This includes logistics fees. Postal shipments from China and Hong Kong now face tariffs up to 120-150% or fixed fees per item. Shipping is now more costly and less certain. Dropshippers often see high logistics costs, especially with untracked or postal shipping. Many now look for local warehouses or suppliers in the destination country. This helps avoid tariffs and makes delivery faster.

Tip: Using local warehouses can cut delivery times from 10–15 days to just 2–3 days and lower per-order costs by about 30%.

Supply Chain Disruption

Customs Delays

Customs delays are now a big problem for dropshippers. The end of the de minimis exemption means every shipment from China and Hong Kong needs customs checks and duties, no matter the value. Customs clearance now needs correct manufacturer prices, HTS codes, and country-of-origin details. This takes longer and mistakes are more likely. Dropshippers using AliExpress or Temu often face shipping delays and higher fees because of stricter customs checks.

Customs clearance takes longer, causing inventory delays and stockouts.

Carriers now charge more for handling and want more paperwork.

These problems affect dropshippers who need fast inventory.

Freight Volumes

Freight volumes have changed because of the new tariffs. Many dropshippers now import bulk inventory to U.S. warehouses. This helps avoid paying tariffs on every order. It also reduces shipping delays and lowers costs per order. But it means spending more money upfront and risking unsold stock. Some sellers have stopped using postal shipments from China. High tariffs and delays make this method too hard.

Bulk importing makes delivery faster and avoids repeated customs delays.

Dropshippers must balance the risk of holding stock with the benefits of faster shipping and lower costs.

Profit Margins

Margin Squeeze

Profit margins are under a lot of pressure. Higher product and shipping costs, plus more delays, squeeze profits for dropshippers. Many now find that low-margin or small items do not work anymore. Tariffs force sellers to raise prices, which can lose customers, or take losses, which hurts profits.

Tariffs make profit margins smaller and competition harder.

Sellers must choose to pass costs to customers or cut costs elsewhere.

High-Margin SKUs

To survive, many dropshippers now focus on high-margin SKUs. These products often come from countries with lower tariffs, like Vietnam, India, Bangladesh, or Turkey. High-margin SKUs usually have steady supply and stable costs. Sellers use profit tracking tools to see which products still make money. They remove low-margin or slow products and focus on best-sellers with strong demand and low tariffs.

High-margin SKUs often use Delivered Duty Paid shipping or product bundling to lower tariff costs.

Businesses spend more on ads for these products to get better returns and keep profits up.

Suppliers who include tax in their prices help dropshippers plan costs and avoid surprises.

Note: Focusing on high-margin SKUs and using analytics tools helps dropshippers keep profits and adapt quickly to tariff changes.

How Tariffs Affect Dropshipping Business

Supplier Diversification

Dropshippers in the USA have a hard choice now. They need to find new ways to get products. Tariffs on Chinese imports are much higher. Before, buying from China was cheap and gave many choices. Now, it costs more and customs checks slow things down. This makes it risky. Many dropshippers look for suppliers in the EU, India, or even in the USA.

EU and India

Getting products from the EU has some good points. Delivery is faster and shipping costs less. Dropshippers can visit factories more easily. There is also less competition than in the USA. But, buying from the EU costs more and VAT takes away some profit.

India is another place to buy products. Prices are low, especially for things made by hand. India has many young workers and its economy is growing fast. Suppliers in India make electronics, clothes, and medicines. But, delivery from India takes longer and quality can be a problem. Shipping is not simple and talking to suppliers can be hard.

Here’s a quick comparison:

Sourcing Region/Method | Advantages | Disadvantages |

|---|---|---|

EU (Local Manufacturers) | Short delivery times, reduced transport costs, ability to visit factories | Higher purchase prices, VAT |

India (International) | Lower prices, large product range, bulk orders possible | Longer delivery times, quality risks, logistics |

US-Based Suppliers | Fast shipping, no tariffs, easier returns | High competition, higher costs |

US-Based Suppliers

Some dropshippers now buy from US suppliers. Buying local means no tariffs and shipping is much faster. Customers get their orders quickly and returns are easy. People in the USA spend a lot, which helps sales. But, there are many sellers and prices are higher than other places. Dropshippers must think about these good and bad points before changing suppliers.

Tip: Using more than one supplier lowers risk. If one supply chain fails, another can help keep the business open.

Pricing Strategies

Tariffs make dropshippers change how they set prices. They must choose to pay the extra costs or charge customers more. Each way has good and bad sides.

Absorbing Costs

Some dropshippers pay the extra costs themselves. They keep prices the same so customers do not leave. This works best for products with high profit or in busy markets. Dropshippers try to get better deals from suppliers or buy more at once. They may sell bundles to spread out tariff costs and make products seem like a better deal.

Paying extra costs can keep sales but lowers profits.

Bundling or special deals can help with losses.

Better shipping plans, like sending more at once, can save money.

Passing Costs On

Other dropshippers raise prices for customers. They do this slowly so people do not stop buying. Some say their products are better or special to explain the higher price. Others show customers why prices went up. Being honest can help customers trust the business.

Raising prices slowly helps keep customers.

Telling customers about tariff fees stops surprises at checkout.

Saying products are special or better can make higher prices okay.

Note: Dropshippers add up all costs, like supplier price, shipping, tariffs, and fees, then add profit. This helps them set fair prices that last.

Compliance Challenges

Tariffs bring more than just higher prices. They also make following rules harder for dropshippers. Owners must keep up with new rules, paperwork, and legal risks.

Documentation

Every order now needs the right papers. This means invoices, customs forms, and proof of where things are made. In the EU, VAT rules are different in each country, which makes things harder. Dropshippers must sign up for VAT, report sales, and handle returns the right way. Mistakes can mean delays, fines, or lost goods.

Each EU country has its own VAT rules and rates.

Dropshippers must sign up, report, and send invoices for each country.

Handling returns and complaints means more paperwork.

Legal Risks

Legal risks are bigger with new tariffs. The end of the de minimis exemption means every order gets checked and taxed. Dropshippers who do not follow the rules can get fined or lose their goods. Problems like shipping delays or cancelled orders can mean more complaints and returns.

Not following customs or VAT rules can mean fines or lost goods.

More returns and complaints can lead to legal trouble.

Dropshippers must know the rules in every country they sell to.

Callout: Following the rules keeps profits safe and the business running well. Check paperwork and legal rules often to avoid mistakes that cost money.

Adaptation Strategies

Dropshipping businesses now have many new problems. They must act fast and think carefully to keep up. Here are some simple ways to help dropshipping stay strong and do well.

Negotiate with Suppliers

Better Terms

Suppliers are very important for dropshipping. Businesses can get better deals if they prepare and know what suppliers want. They should build trust and talk often. Showing good sales or loyal customers can help get lower prices. Some even get special products or discounts by working closely with suppliers.

Learn what suppliers can and cannot do before talking.

Build trust by being honest and talking often.

Show off your business strengths, like good sales or loyal buyers.

Be ready to talk about payment, shipping, or extras.

Look at all costs, not just the price for each item.

If the deal is not good, walk away but stay polite.

Always write down deals and check them often.

Keep watching how suppliers do and talk about deals again if needed.

Some dropshipping businesses have saved up to 20% and got special deals by using these ideas.

Cost Sharing

Tariffs make things hard for everyone. Many dropshipping businesses now share these costs with suppliers. They work together to save money and get better deals. Some change to suppliers in places with lower tariffs. Others ask for more time to pay or discounts for paying early. Working together for a long time helps both sides with new costs.

Ask to split tariff costs to help both sides.

Work with suppliers to find ways to save money.

Try to get products from places with fewer tariffs.

Ask for more time to pay to help with money flow.

Make long deals for better results.

Focus on High-Margin Products

SKU Selection

Picking the right products is very important now. Many choose items with low tariff risk. They test prices to see what works best. Some put products together to keep value high. Dropshipping businesses also use suppliers from different countries to lower risk.

Test prices to find the best balance.

Bundle products to keep value up.

Use suppliers from different countries.

Check for free trade deals or tariff breaks.

Profit Analysis

Making money is more important than ever. Dropshipping businesses use tools to check profit for each product. They add tariffs and shipping to the cost. They look at profit margins and compare to others. Many use software to track costs and find problems early.

Use break-even checks to see how many sales cover costs.

Check profit margins for every product.

Use software to track and compare profits.

Change products or suppliers if profits go down.

Leverage Technology

Automation Tools

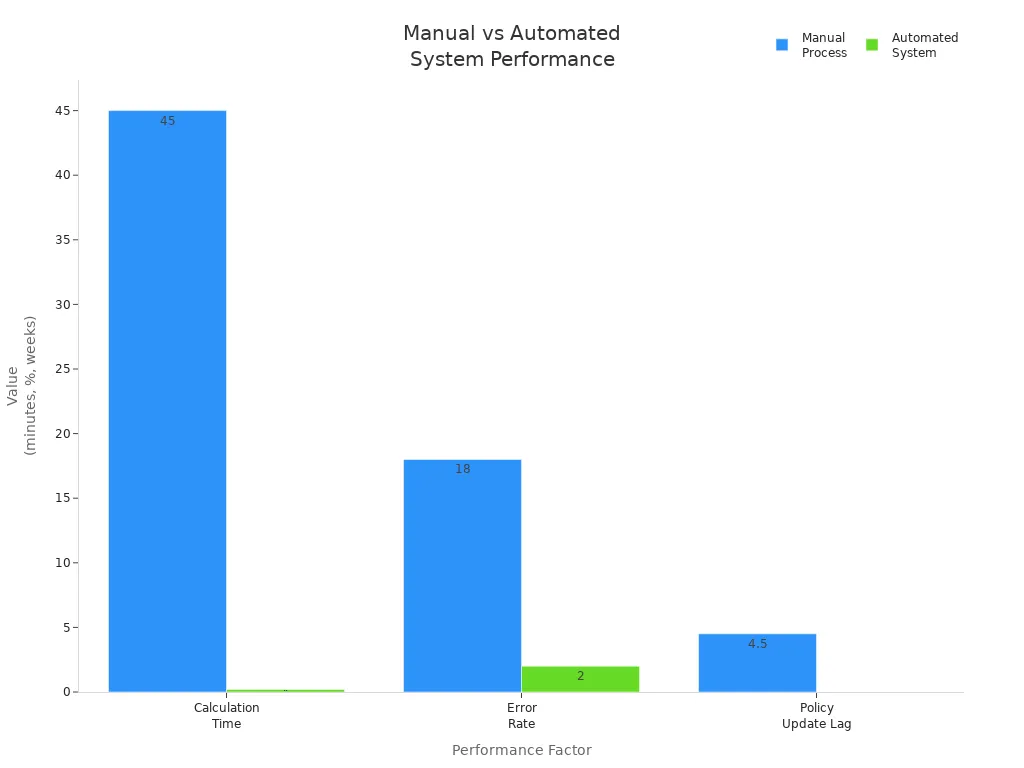

Automation makes dropshipping easier. AI tools help with product codes and customs forms. They cut mistakes and save time. Many tools give updates on tariffs for over 200 countries. They also connect with online shops for quick landed cost checks.

Factor | Manual Process | Automated System |

|---|---|---|

45 minutes | 12 seconds | |

Error Rate | 18% | 2% |

Policy Update Lag | 3-6 weeks | Instant |

A logistics manager said, “Our dashboard found a 9% duty drop in the European Union before our team did. That saved $4,800 last quarter.” This shows how automation helps with rules and saving money.

Tariff Calculators

Tariff calculators help dropshipping businesses keep track of costs. They add tariffs, duties, and shipping to each product’s price. These tools update right away when trade rules change. They help avoid mistakes and keep profits up. Many try these tools on a few products before using them for everything.

Tip: Dropshipping businesses should check their supply chain and prices often. Being quick and using the right tools helps dropshipping stay strong, even when tariffs change.

Future of Dropshipping Business

Market Trends

Domestic Sourcing

Dropshipping businesses now look for products closer to home. Many pick domestic suppliers to avoid high tariffs and slow shipping. This helps them deliver faster and keep customers happy. Local sourcing means fewer customs checks and easier returns. Some dropshippers use both local and international suppliers. This mix gives them more choices and helps control costs.

Dropshippers use local suppliers to make shipping faster.

They build new partnerships to lower supply chain risks.

Many choose eco-friendly and fair products because customers care about the planet.

A mix of suppliers helps them stay flexible and meet new market needs.

Global trade problems and new rules make dropshippers change their supply chains. Many now use more domestic suppliers to avoid problems and keep their businesses running well.

Trade Shifts

The dropshipping industry faces big changes in world trade. Tariffs on Chinese and Mexican imports make businesses find new suppliers. Many look at countries like Vietnam and India for better prices. Some use U.S. warehouses and third-party logistics to deliver faster. Others work on building stronger brands to stand out.

Here’s a quick look at how dropshippers handle these changes:

Market Trend / Challenge | Business Adaptation Strategy |

|---|---|

Higher product costs from import tariffs | Switching to local suppliers to cut shipping and delivery times |

Shipping delays and higher logistics costs | Using U.S. warehouses and 3PLs for faster delivery |

Tariffs on Chinese and Mexican imports | Looking at Vietnam and India for new suppliers |

More competition and higher ad costs | Building strong brands and selling niche products |

Customers worry about prices going up | Improving customer service and offering loyalty rewards |

Supply chain risks and supplier problems | Using more suppliers from different places |

Need for faster delivery and better service | Using 3PLs and making customer service better |

Market changes and new chances | Expanding into new markets with smart marketing |

Long-Term Viability

Resilience

Dropshipping businesses show they can bounce back in hard times. They change suppliers quickly and use new technology. Many now work with local fulfilment centres to avoid tariffs and delays. They also use automation tools to make things run smoother. Some focus on high-margin products like eco-friendly or health items to keep profits up. Others make customer service better with faster shipping and good support.

Regional warehouses make delivery faster and returns easier.

Selling expensive items helps cover extra costs.

Innovation

Innovation helps dropshipping businesses stay ahead. They try new ideas to deal with tariffs and market changes. Many use suppliers from different countries. Some talk to suppliers to share tariff costs or use bonded warehouses to delay customs fees. Others use AI to guess tariff changes and plan ahead. A few even use blockchain for smart contracts that change prices by themselves.

Dropshippers form groups to share resources and have a bigger voice.

Shared inventory in warehouses helps save money.

Free Trade Zones let them store goods without paying duty until needed.

Modular product design lets them put products together in different countries, which lowers tariffs and speeds up shipping.

Dropshipping businesses that stay flexible and try new ideas will do well, no matter how the market changes.

The new tariffs have a big impact on dropshipping businesses. They change how people buy, sell, and ship products. Dropshippers need to check their supply chains and focus on high-margin items. Staying alert to every new impact helps them stay ahead. They can use new tools, try fresh ideas, and keep learning. Now is the time to adapt, spot new chances, and build a business that lasts.

FAQ

What are the new tariffs, and who do they affect?

The new tariffs are extra taxes on things brought into the country. They mostly affect dropshippers who buy from China, Mexico, or Canada. Now, many small businesses pay more for every order.

Can dropshippers still make a profit with higher tariffs?

Yes, but they must change how they work. They can sell high-margin products, use local suppliers, or bundle items together. Many dropshippers also try to get better deals from suppliers to keep making money.

How can dropshippers avoid customs delays?

They can use local warehouses or pick suppliers from countries with fewer checks. Automation tools help fill out customs forms fast. Correct paperwork means fewer mistakes and quicker delivery.

Do all products face the same tariff rates?

No, tariff rates are different for each product and country. Electronics and car parts often have higher rates. Dropshippers should check the tariff for every product before selling it.

What happens if a dropshipper does not follow new rules?

They could get fined, lose goods, or have shipments blocked. Dropshippers must keep their paperwork right and know the latest rules. Many use software to track rule changes and avoid mistakes.

Is it better to use US-based suppliers now?

US-based suppliers ship faster and do not have tariffs. But their prices are usually higher. Dropshippers often use both local and overseas suppliers to balance cost and speed.

How do dropshippers explain price increases to customers?

They can be honest about higher costs. Some add a note at checkout or in product details. Good communication helps keep customers’ trust.

What tools help dropshippers manage tariffs?

Tariff calculators and automation tools help track costs and fill out forms. Many dropshippers use these tools to save time and stop errors.

TangBuy: A Smarter Way to Dropship in 2025

If you're looking to stay competitive with dropshipping in 2025, speed and trend-awareness are key. TangBuy helps you stay ahead with real-time product trends, fast fulfilment, and factory-direct sourcing. With over 1 million ready-to-ship items, 24-hour order processing, and seamless Shopify integration, TangBuy makes it easier to test, scale, and succeed in today's fast-moving eCommerce landscape.

See Also

Understanding The Real Expenses Of Dropshipping In 2025

Evaluating Whether Doba Suits New Dropshippers In 2025

Effective Ways To Manage Shipping Costs In Dropshipping

Complete 2025 Guide To Using CJdropshipping Chrome Extension

Essential Tips For Achieving eBay Dropshipping Success In 2025